SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. ______)

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

ASSURE HOLDINGS CORP.

|

(Name of Registrant as Specified in its Charter)

|

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| ASSURE

HOLDINGS CORP. NOTICE OF SPECIAL MEETING OF STOCKHOLDERS To all Stockholders of Assure Holdings Corp.: |

|

You are invited to attend a Special Meeting of Stockholders (the “Special Meeting”) of Assure Holdings Corp. (the “Company”). The Special Meeting will be held at the Las Vegas Marriott Laughlin Conference Center, 17th Floor, 325 Convention center Drive, Las Vegas, Nevada, 89109 on Tuesday, April 30, 2024, at 2:00 p.m. Pacific Standard Time (“PST ”). The purposes of the Special Meeting are:

| 1. | To approve the amendment of the Company’s Articles of Incorporation, to increase the number of authorized shares (the “Authorized Share Increase”) in the Company’s common shares from 9,000,000 to 250,000,000; | |

| 2. | To authorize the adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal No. 1 (the “Adjournment Proposal”); and | |

| 3. | To conduct any other business that may properly come before the Special Meeting. |

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH PROPOSAL.

The Board of Directors has fixed April 11, 2024 as the record date for the Special Meeting. Only stockholders of the Company of record at the close of business on that date will be entitled to notice of, and to vote at, the Special Meeting. A list of stockholders as of April 11, 2024 will be available at the Special Meeting for inspection by any stockholder. Stockholders will need to register online as provided below to attend and vote at the Special Meeting. Each share of our common stock is entitled to one vote on each of the matters before the stockholders. If your shares of common stock are not registered in your name, you will need to obtain a proxy from the broker, bank or other institution that holds your shares of common stock in order to register to attend and vote at the Special Meeting. You should ask the broker, bank or other institution that holds your shares to provide you with a proxy to vote your shares of common stock at the Special Meeting.

Your vote is important. You are requested to carefully read the accompanying Proxy Statement for the Special Meeting for a more complete statement of matters to be considered at the Special Meeting. Whether or not you expect to attend the Special Meeting, please sign and return the enclosed proxy card or vote your proxy online pursuant to the instructions thereon, promptly. If you decide to attend the Special Meeting, you may, if you wish, revoke the proxy and vote your shares of common stock using a ballot during the Special Meeting. Additional details concerning the matters to be put before the Special Meeting are set forth in the Company’s Proxy Statement for the Special Meeting of Stockholders which accompanies this Notice of Meeting.

IF YOU RETURN YOUR PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED “FOR” EACH MATTER AT THE SPECIAL MEETING.

By Order of the Board of Directors,

| ASSURE HOLDINGS CORP. | |

| /s/ John Farlinger | |

| Executive Chairman and Chief Executive Officer | |

| April 16, 2024 |

2

THIS PAGE INTENTIONALLY LEFT BLANK

3

ASSURE HOLDINGS CORP.

7887 E. BELLEVIEW AVENUE, SUITE 240

DENVER • COLORADO • USA • 80111

PROXY STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 24, 2024

Unless the context requires otherwise, references in this Proxy Statement to “Assure Holdings”, “Assure”, the “Company”, “we”, “us” or “our” refer to Assure Holdings Corp.

The Special Meeting of Stockholders of Assure Holdings (the “Special Meeting”) will be at Las Vegas Marriott Laughlin Conference Center, 17th Floor, 325 Convention center Drive, Las Vegas, Nevada, 89109 on Friday, April 26, 2024, at 2:00 p.m. Pacific Standard Time (“PST”).

We are providing the enclosed proxy materials and form of proxy (the “Proxy Statement”) in connection with the solicitation by the Company’s Board of Directors (the “Board”) of proxies for this Special Meeting. The Company anticipates that this Proxy Statement and the form of proxy will be made available to holders of the Company’s shares of common stock (the Company’s shares of common stock will be referred to as “shares” and the whole class of common stock referred to as the “common stock”) on or about April 9, 2024.

You are invited to attend the Special Meeting at the above stated time and location. If you plan to attend and your shares are held in “street name” – in an account with a bank, broker or other nominee – you must obtain a proxy issued in your name from such broker, bank or other nominee. Please bring that documentation to the Special Meeting.

You can vote your shares by completing and returning the proxy card or, if you hold shares in “street name,” by completing the voting form provided by the broker, bank or other nominee.

A returned signed proxy card without an indication of how shares should be voted will be voted “FOR” each matter at the Special Meeting.

Our corporate bylaws define a quorum as 33-1/3% of the common stock entitled to vote at any meeting of stockholders. The affirmative vote of a majority of Company’s outstanding voting shares is required to approved the Authorized Shares Increase. The affirmative vote of the shares cast on the proposal by stockholders present at the Special Meeting, whether in person or by proxy, and entitled to vote thereon is required to approve the Adjournment Proposal.

Important Notice Regarding the Availability of Proxy Materials for the Meeting to be Held on April 24, 2024

The proxy materials, which include the Notice of Special Meeting, this Proxy Statement and the accompanying Proxy Card, can be found at http://www.proxyvote.com. Information contained on or connected to the website is not incorporated by reference into this Proxy Statement and should not be considered a part of this Proxy Statement or any other filing that we make with the Securities and Exchange Commission.

This Proxy Statement is also available on the Company’s website at https://ir.assureneuromonitoring.com or will be provided by the Company, upon request, by mail at Assure Holdings Corp., 7887 E. Belleview Ave., Suite 240, Denver, Colorado, USA 80111, Attention: John Farlinger, Chief Executive Officer; or by email at ir@assureiom.com, free of charge to stockholders. The Company may require the payment of a reasonable charge from any person or corporation who is not a stockholder and who requests a copy of any such document. Financial information relating to the Company is provided in the Company’s comparative consolidated financial statements and management’s discussion and analysis for its most recently completed fiscal year which are contained in its Annual Report on Form 10-K. Additional information relating to the Company is available electronically on EDGAR at www.sec.gov/edgar.shtml.

QUESTIONS AND ANSWERS ABOUT PROXY MATERIALS AND VOTING

Why am I receiving this Proxy Statement and Proxy Card?

You are receiving this Proxy Statement and the accompanying Proxy Card because you were a stockholder of record at the close of business of April 11, 2024 and are entitled to vote at the Special Meeting. This Proxy Statement describes issues on which the Company would like you, as a stockholder, to vote. It provides information on these issues so that you can make an informed decision. You do not need to attend the Special Meeting to vote your shares.

4

When you sign the Proxy Card, you appoint John Farlinger, Chief Executive Officer and Executive Chairman of the Board of the Company, and Paul Webster, Chief Financial Officer of the Company, as your representatives at the Special Meeting. As your representatives, they will vote your shares at the Special Meeting (or any adjournments or postponements) in accordance with your instructions on your Proxy Card. With proxy voting, your shares will be voted whether or not you attend the Special Meeting. Even if you plan to attend the Special Meeting, it is a good idea to complete, sign and return your Proxy Card or vote your Proxy Card online pursuant to the instructions thereon in advance of the Special Meeting just in case you change your plans.

If an issue comes up for vote at the Special Meeting (or any adjournments or postponements) that is not described in this Proxy Statement, your representatives will vote your shares, under your proxy, in their discretion, subject to any limitations imposed by law.

When is the record date?

The Board has fixed April 2, 2024 as the record date for the Special Meeting. Only holders of shares of the Company’s common stock as of the close of business on that date will be entitled to vote at the Special Meeting.

How many shares are outstanding?

As of April 11, 2024, the Company had 9,000,000 shares of common stock issued and outstanding. The Company’s common stock is the only outstanding voting security of the Company.

What am I voting on?

You are being asked to vote on the following:

| 1. | To approve the amendment of the Company’s Articles of Incorporation, to increase the number of authorized shares (the “Authorized Share Increase”) in the Company’s common shares from 9,000,000 to 250,000,000; |

| 2. | To authorize the adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal No. 1 (the “Adjournment Proposal”); and |

| 3. | To conduct any other business that may properly come before the Special Meeting. |

How many votes do I get?

Each share of our common stock is entitled to one vote on each of the matters before the stockholders. No cumulative rights are authorized, and dissenters’ rights are not applicable to any of the matters being voted upon.

The Board recommends a vote “FOR” the amendment for the Authorized Share Increase and “FOR” the Adjournment Proposal, in each case, as disclosed in this Proxy Statement.

How do I vote?

You have several voting options. You may vote by:

| · | by using the 11-digit control number located at the bottom of your Proxy Card at the following website: www.proxyvote.com; | |

| · | calling 1-800-690-6903 (toll free in North America); | |

| · | marking, signing and mailing your Proxy Card in the postage-paid envelope provided with the Proxy Card; or | |

| · | attending the Special Meeting and voting in person. |

Are you a non-registered holder?

The information set out in this section is important to many stockholders as a substantial number of stockholders do not hold their shares in their own name. Only registered stockholders or duly appointed proxyholders for registered stockholders are permitted to vote in person at the Special Meeting. Most of the stockholders are “non-registered” stockholders (each a “Non-Registered Holder”) because the shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the shares.

5

More particularly, a person is a Non-Registered Holder in respect of shares which are held on behalf of that person but which are registered either (a) in the name of an intermediary (the “Intermediary”) that the Non-Registered Holder deals with in respect of the shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSP’s, RRIF’s, RESP’s and similar plans), or (b) in the name of a clearing agency (such as, in the United States, shares registered in the name of “Cede & Co.”, the registration name of The Depository Trust Company (“DTC”), or in Canada, shares registered in the name of “CDS & Co.”, the registration name of The Canadian Depository for Securities Limited (“CDS”)) of which the Intermediary is a participant. As noted below, in accordance with Regulation 14A under the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the requirements of National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) of the Canadian Securities Administrators, the Company will be mailing the Notice of Special Meeting, this Proxy Statement and the form of Proxy Card/voting instruction form (collectively, the “Special Meeting Materials”), directly to certain non-objecting Non-Registered Holders and in certain instances has distributed the Special Meeting Materials to the clearing agencies and Intermediaries for onward distribution to objecting Non-Registered Holders. Intermediaries are required to provide the Special Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Very often, Intermediaries will use service companies to forward the Special Meeting Materials to Non-Registered Holders. Generally, if you are a Non-Registered Holder and you have not waived the right to receive the Special Meeting Materials you will either:

| (a) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature) which is restricted to the number of shares beneficially owned by you, but which is otherwise not complete. Because the Intermediary has already signed the proxy, this proxy is not required to be signed by you when submitting it. In this case, if you wish to submit a proxy you should otherwise properly complete the executed proxy provided and mail it as provided in the instructions of the Intermediary or its service company; or |

| (b) | more typically, a Non-Registered Holder will be given a voting instruction form which is not signed by the Intermediary, and which, when properly completed and signed by the Non-Registered Holder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “proxy”, “proxy authorization form” or “voting instruction form”) which the Intermediary must follow. Typically, the voting instruction form will consist of a one-page pre-printed form. Sometimes, instead of the one-page printed form, the voting instruction form will consist of a regular printed proxy accompanied by a page of instructions that contains a removable label containing a bar-code and other information. In order for the proxy to validly constitute a voting instruction form, the Non-Registered Holder must remove the label from the instructions and affix it to the proxy, properly complete and sign the proxy and return it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company. |

In either case, the purpose of this procedure is to permit Non-Registered Holders to direct the voting of the shares that they beneficially own. If you are a Non-Registered Holder and you wish to vote at the Special Meeting as proxyholder for the shares owned by you, you should strike out the names of the designated proxyholders named in the proxy authorization form or voting instruction form and insert your name in the blank space provided. In either case, you should carefully follow the instructions of your Intermediary, including when and where the proxy, proxy authorization or voting instruction form is to be delivered.

The Special Meeting Materials are being made available to both registered stockholders and Non-Registered Holders. The Company is sending the Special Meeting Material directly to Non-Registered Holders who have not objected to the Intermediary through which their shares are held disclosing ownership information about themselves to the Company (“NOBO’s”) under Regulation 14A of the Exchange Act. If you are a NOBO, and the Company or its agent has sent you the Special Meeting Materials, your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the Intermediary on your behalf. If you are a Non-Registered Holder who has objected to the Intermediary through which your shares are held disclosing ownership information about you to the Company (an “OBO”), your Intermediary will be forwarding you the Special Meeting Materials in accordance with the requirements of Regulation 14A and the Company will be covering the cost of such mailings.

Can stockholders vote at the Special Meeting?

Registered stockholders and appointed proxyholders will be given a ballot to vote at the Special Meeting. Stockholders who wish to appoint a third-party proxyholder to attend the Special Meeting and submit votes during the Special Meeting must provide their third-party proxyholders with a valid, signed proxy for submission at the Special Meeting to receive a ballot. If you are a Non-Registered Holder and wish to vote your shares at Special Meeting, you will need to obtain a valid, signed proxy naming yourself as proxyholder from your Intermediary. By doing so, you are instructing your Intermediary to appoint you as proxyholder.

What if I share an address with another stockholder and we received only one copy of the Special Meeting Materials?

If certain requirements are met under relevant U.S. securities law, including in some circumstances the stockholders’ prior written consent, we are permitted to deliver one Proxy Statement to a group of stockholders who share the same address. If you share an address with another stockholder and have received only one copy of the Special Meeting Materials, but desire another copy or desire to receive separate copies in relation to future meetings of the stockholders, please send a written request to our offices at the address below or call us at 720-287-3093 to request another copy of the materials or separate delivery of materials. Please note that each stockholder should receive a separate Proxy Card to vote the shares they own.

6

Send requests to:

Assure Holdings Corp.

7887 E. Belleview Ave., Suite 240

Denver, Colorado, USA 80111

Attention: John Farlinger, Chief Executive Officer

Stockholders who hold shares in street name (as described below) may contact their brokerage firm, bank, broker-dealer, or other similar organization to request information about householding.

What if I change my mind after I vote?

You may revoke your vote/proxy and change your vote at any time before the polls close at the Special Meeting. You may do this by:

| · | going online and completing a new proxy at www.proxyvote.com; | |

| · | calling 1-800-690-6903 and changing your vote; | |

| · | requesting and signing another Proxy Card with a later date and mailing it using the postage-paid envelope provided, so long as it is received prior to 5 p.m. Eastern Standard Time on April 26, 2024; | |

| · | signing and delivering a written notice of revocation (in the same manner as a proxy is required to be executed as set out in the notes to the Proxy Card) to the Company’s Secretary, at Assure Holdings Corp., 7887 E. Belleview Ave., Suite 240, Denver, Colorado, USA 80111 prior to 5 p.m. Eastern Standard Time on April 26, 2024 or with the Chair of the Special Meeting on the day of the Special Meeting prior to the commencement of the Special Meeting; or | |

| · | attending the Special Meeting and voting in person through a ballot. |

Beneficial stockholders should refer to the instructions received from their broker, bank or intermediary or the registered holder of the shares if they wish to change their vote.

How many votes do you need to hold the meeting?

To conduct the Special Meeting, the Company must have a quorum, which means 33-1/3% of the common stock entitled to vote at any meeting of stockholders. The common stock is the only outstanding voting stock of the Company. Based on 9,000,000 shares outstanding as of the record date of April 11, 2024, 3,000,000 shares must be present in person or by proxy for the quorum to be reached. Your shares will be counted as present at the Special Meeting if you:

| · | submit a properly executed Proxy Card (even if you do not provide voting instructions); or | |

| · | attending the Special Meeting and voting in person through a ballot. |

What if I abstain from voting?

Abstentions with respect to a proposal are counted for the purposes of establishing a quorum but are not counted as votes “cast” on the proposal. Since the Company’s bylaws state that matters presented at a meeting of the stockholders must be approved by the majority of the votes “cast” on the matter, a properly executed proxy card marked “ABSTAIN” with respect to a proposal will not be considered a vote “cast” and will have no effect on the outcome of the Adjournment Proposal; provided however that approval of the Authorized Share Increase requires the affirmative vote of a majority of the issued and outstanding shares of common stock as of the Record Date and therefore any proxy card marked “ABSTAIN” in relation to such proposal will have the same effect as a vote “AGAINST” such proposal.

What effect does a broker non-vote have?

Brokers and other Intermediaries holding shares for Non-Registered Holders are generally required to vote the shares in the manner directed by the Non-Registered Holders. If the Non-Registered Holders do not give any direction, brokers may vote the shares on routine matters but may not vote the shares on non-routine matters. Both the Authorized Share Increase and the Adjournment Proposal are expected to be treated as non-routine matters.

The absence of a vote on a non-routine matter is referred to as a broker non-vote. Broker non-votes are considered present at the Special Meeting for quorum requirements but are not considered votes “cast” on non-routine matters. Any shares represented at the Special Meeting but not “cast” as a result of a broker non-vote will have the same effect as a vote “AGAINST” each of the Authorized Share Increase and the Adjournment Proposal.

7

How many votes are needed to approve the Authorized Share Increase?

Approval of the Authorized Share Increase requires the affirmative vote of a majority of the issued and outstanding shares of common stock as of the Record Date. Broker non-votes and proxy cards marked “ABSTAIN” will have the same effect as a vote “AGAINST” the Authorized Share Increase.

How many votes are needed to approve the Adjournment Proposal?

The Adjournment Proposal will be approved by an affirmative vote of a majority of the votes cast at the Special Meeting by stockholders present at the Special Meeting, in person or by proxy, and entitled to vote thereon. Broker non-votes and a properly executed proxy card marked “ABSTAIN” with respect to this proposal will not have an effect on the outcome of this proposal.

Will my shares be voted if I do not sign and return my Proxy Card?

If your shares are held through a brokerage account, your brokerage firm, under certain circumstances and subject to certain legal restrictions, may vote your shares, otherwise your shares will not be voted at the meeting. See “What effect does a broker non-vote have?” above for a discussion of the matters on which your brokerage firm may vote your shares.

If your shares are registered in your name and you do not sign and return your proxy card, your shares will not be voted at the Special Meeting.

What happens if I do not indicate how to vote my proxy?

If you just sign your Proxy Card without providing further instructions, your shares will be “FOR” each matter at the Special Meeting.

Where can I find the voting results of the meeting?

Within four (4) business days of the Special Meeting, the Company will file a current report on Form 8-K with the United States Securities and Exchange Commission (the “SEC”) announcing the voting results of the Special Meeting.

Who will pay for the costs of soliciting proxies?

The Company will bear the cost of soliciting proxies. In an effort to have as large a representation at the meeting as possible, the Company’s directors, officers and employees may solicit proxies by telephone or in person in certain circumstances. These individuals will receive no additional compensation for their services other than their regular compensation. Upon request, the Company will reimburse brokers, dealers, banks, voting trustees and their nominees who are holders of record of the Company’s Common Stock on the record date for the reasonable expenses incurred in mailing copies of the Special Meeting Materials to the beneficial owners of such shares. The Company may also determine to pay a proxy solicitor to solicit proxies on behalf of the Company and will provide information on the fees paid to such solicitor upon engagement to conduct such activities.

We have engaged Advantage Proxy, Inc. as the proxy solicitor for the Special Meeting for a base fee ranging from $7,500 to $12,500 plus fees for additional services, if any. We have also agreed to reimburse Advantage Proxy, Inc. for its reasonable out of pocket expenses.

Are there any other matters to be handled at the Special Meeting?

We are not currently aware of any business to be acted upon at the Special Meeting other than the proposals discussed in this Proxy Statement and the date for submission of matters under federal securities laws and the Company’s bylaws has passed. The form of proxy accompanying this Proxy Statement confers discretionary authority upon the named proxy holders with respect to amendments or variations to the matters identified in the accompanying Notice of Special Meeting and with respect to any other matters which may properly come before the Special Meeting or at any adjournment(s) or postponement(s) of the Special Meeting. If other matters do properly come before the Special Meeting, or at any adjournment(s) or postponement(s) of the Special Meeting, shares of our common stock, represented by properly submitted proxies, will be voted by the proxy holders in accordance with their best judgment to the extent permitted by applicable law.

Who can help answer my questions?

You can contact our Chief Executive Officer, John Farlinger, at 720-287-3093 or by sending a letter to John Farlinger at the Company’s headquarters at Assure Holdings Corp., 7887 E. Belleview Ave., Suite 240, Denver, Colorado, USA 80111 or by e-mail to john.farlinger@assureiom.com with any questions about the proposals described in this Proxy Statement or how to execute your vote.

8

When are stockholder proposals due for the 2024 annual meeting of stockholders?

Under the Exchange Act, the deadline for submitting stockholder proposals for inclusion in the proxy statement for an annual meeting of the stockholders is calculated in accordance with Rule 14a-8(e) of Regulation 14A to the Exchange Act. If the proposal is submitted for a regularly scheduled annual meeting, the proposal must be received at the Company’s principal executive offices not less than 120 calendar days before the anniversary date on which the Company’s proxy statement was released to the stockholders in connection with the previous year’s annual meeting. However, if the Company did not hold an annual meeting the previous year, or if the date of the current year’s annual meeting has been changed by more than 30 days from the date of the previous year’s meeting, then the deadline is a reasonable time before the Company begins to print and mail its proxy materials. The deadline for submitting stockholder proposals for inclusion in the proxy statement for the next annual meeting of the stockholders will be August 7, 2024. If a stockholder proposal is not submitted to the Company by August 7, 2023, the Company may still grant discretionary proxy authority to vote on a stockholder proposal, if such proposal is received by the Company by October 21, 2024 in accordance with Rule 14a-4(c)(1) of Regulation 14A of the Exchange Act. If the date for the annual meeting in 2023 is moved by more than 30 days, the Company will update the stockholders regarding the deadlines set forth above by filing a Current Report on Form 8-K in relation thereto.

Under the Company’s bylaws, stockholders may submit nominees for election to the Board pursuant to the requirements set forth therein. The written notice of such nominations must be provided to the Company’s Corporate Secretary, at the Company’s headquarters at Assure Holdings Corp., 7887 E. Belleview Ave., Suite 240, Denver, Colorado, USA 80111, not less than 30 days prior to the date of the annual meeting of stockholders; provided, however, that in the event that the annual meeting of stockholders is called for a date that is less than 50 days after the date on which the first public announcement of the date of the annual meeting was made, notice may be made not later than the close of business on the 10th day following such public notice date pursuant to the Company’s bylaws.

In addition to satisfying the foregoing requirements under the Company’s bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees for the 2024 annual meeting must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than October 28, 2024, unless the date of our 2024 annual meeting has changed by more than 30 days calendar days from this year's annual meeting in which case such notice will be due on the later of 60 calendar days prior to the date of the annual meeting or the 10th calendar day following the day on which public announcement of the date of the annual meeting is first made.

How can I obtain a copy of the most recent Annual Report on Form 10-K?

The Company’s most recent Annual Report on Form 10-K, including financial statements, is available through the SEC’s website at www.sec.gov.

At the written request of any stockholder who owns shares on the record date, the Company will provide to such stockholder, without charge, a paper copy of the Company’s most recent Annual Report on Form 10-K as filed with the SEC, including the financial statements, but not including exhibits. If requested, the Company will provide copies of the exhibits for a reasonable fee.

Requests for additional paper copies of the Annual Report on Form 10-K should be mailed to:

Assure Holdings Corp.

7887 E. Belleview Ave., Suite 240

Denver, Colorado, USA 80111

Attention: John Farlinger, Chief Executive Officer

What materials accompany this Proxy Statement?

The following materials accompany this Proxy Statement:

| 1. | The Notice of Special Meeting; and | |

| 2. | Proxy Card. |

How is the Company accommodating stockholders amid the COVID-19 pandemic?

The Company is continuously monitoring coronavirus (COVID-19). The Company reserves the right to take any additional precautionary measures it deems necessary in relation to the Special Meeting in response to further development in respect of COVID-19 that the Company considers necessary or advisable including changing the time or location of the Special Meeting. Changes to the Special Meeting time, date or location and/or means of holding the Meeting may be announced by way of press release. Please monitor the Company’s press releases as well as its website at www.assureneuromonitoring.com for updated information. The Company advises you to check its website one week prior to the Special Meeting date for the most current information. The Company does not intend to prepare or mail an amended Proxy Statement in the event of changes to the Special Meeting format, unless required by law.

9

PROPOSAL 1 — APPROVAL OF THE INCREASE TO THE AUTHORIZED SHARES OF COMMON STOCK

Introduction

The Board has unanimously approved, subject to stockholder approval, an amendment to our Amended Articles of Incorporation (“Articles of Incorporation”) to increase the number of authorized shares of our common stock from 9,000,000 shares, par value $0.001, to 250,000,000 shares, par value $0.001 (such amendment as shown in Appendix B). The remaining provisions of our Articles of Incorporation would remain unchanged. The Board has determined that this amendment is in the best interest of the Company and its stockholders and recommends that the stockholders approve this amendment.

Why did the Board approve the Authorized Share Increase?

We believe that the Authorized Share Increase, if approved, will provide us with the flexibility to settle our obligations under outstanding convertible notes and debentures through the issuance of shares of our common stock, meet our obligations under our outstanding warrants, provide room to issue stock awards to help retain our officers and employees and to issue shares of common stock in future equity financings to meet our ongoing capital requirements.

Additionally, on February 12, 2024, Assure entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Danam Health, Inc. (“Danam”) and Assure Merger Corp., a newly formed wholly-owned subsidiary of Assure (“Assure Merger”). Upon the terms and subject to the satisfaction of the conditions described in the Merger Agreement, including approval of the transaction by the stockholders of Assure and Danam, Assure Merger will be merged with and into Danam (the “Merger”), with Danam surviving the Merger as a wholly-owned subsidiary of Assure.

Subject to the terms and conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”): (i) each share of Danam capital stock issued and outstanding immediately prior to the Effective Time shall automatically be converted into and become the right to receive the applicable per share portion of the “merger consideration” as set forth in the allocation statement to be delivered pursuant to the Merger Agreement (“merger consideration” is defined in the Merger Agreement to mean a number of shares of common stock of Assure equal to (a) the quotient obtained by dividing (i) the number of shares of Assure capital stock on a fully diluted basis (the “Assure Fully Diluted Share Number”) by (ii) the quotient of (A) the adjusted value of Assure divided by (B) the sum of the adjusted value of Assure and the adjusted value of Danam, minus (b) the Assure Fully Diluted Share Number minus (c) the number of shares of common stock of Assure the warrants of Danam will become exercisable for upon closing of the Merger); (ii) each outstanding warrant of Danam will be assumed by Assure and become a warrant to purchase an adjusted number of shares of common stock of Assure, at an adjusted exercise price per share but subject to the same terms and conditions as the warrant of Danam.

Following closing of the Merger, the former Assure equityholders immediately before the Merger are expected to own approximately 10% of the outstanding capital stock of the combined company on a fully diluted basis and the equityholders of Danam immediately before the Merger are expected to own approximately 90% of the outstanding capital stock of the combined company on a fully diluted basis.

Upon closing of the Merger, Assure will be renamed Danam Health Holdings Corp. Suren Ajjarapu will serve as Chairman of the Board of Directors and Tim Canning will serve as the Chief Executive Officer of the combined company. The Merger Agreement provides that the Board of Directors of the combined company will be comprised of five members which will be filled upon completion of the Merger to be designated by Danam.

How many shares of Common Stock are currently outstanding or subject to issuance?

As of April 11, 2024, we had 9,000,000 shares of common stock authorized for issuance under our Articles of Incorporation of which nil shares of common stock were unissued. We have the following obligations and potential obligations to issue shares of common stock in the future, which total approximately 2 million shares of common stock:

| · | 194,974 shares of common stock issuable upon the exercise of outstanding warrants with an average weighted exercise price of $71.25; |

| · | 21,055 shares of common stock issuable upon the exercise of outstanding stock options with an average weighted exercise price of $121.65; |

| · | 30,584 shares of common stock issuable upon conversion of convertible notes; and. |

| · | approximately 1.8 million shares of common stock issuable upon conversion of a $1 million convertible note issued to Danam; and. |

10

If the Authorized Share Increase is approved, it will increase the number of shares of common stock available for issuance to (i) settle our obligations under our convertible notes, our debenture with Centurion Asset Management Inc., our convertible note with Danam and our trade accounts payable, (ii) meet our obligations under our outstanding warrants, provide room to issue stock awards to help retain our officers and employees, (iii) issue shares of common stock in future equity financings to meet our ongoing capital requirement . Absent the availability of shares of common stock, the Company may be forced to settle its obligations under the convertible notes, debenture with Centurion, convertible note with Danam and our trade accounts payable entirely by the payment of cash, if available. If the Company does not have sufficient cash to settle these obligations, the Company may be unable to continue operations if it cannot otherwise negotiate the settlement of such obligations.

For this reason, the Board determined that the Authorized Share Increase would give the Company greater flexibility in settling these securities by increasing the number of shares of common stock available for issuance.

What is the purpose of the Authorized Share Increase?

The Board recommends the Authorized Share Increase for the following reasons:

| · | To provide flexibility for the Company to settle its obligations under its convertible notes, debenture with Centurion, convertible note with Danam and trade accounts payable through the issuance of shares of common stock; |

| · | To permit the Company to make future issuances or exchanges of common stock for capital raising purposes or to restructure outstanding securities of the Company; |

| · | To permit the Company to make future issuances of options, warrants and other convertible securities; and |

| · | To permit the Company to issue shares as “merger consideration” upon closing of the Merger. |

What could happen if the stockholders do not approve the Authorized Share Increase?

In the event the Authorized Share Increase is not approved, there may not be sufficient shares of common stock to settle our convertible notes, our debenture with Centurion, the convertible note with Danam or our trade accounts payable. If we are unable to issue shares of common stock in settlement of these obligations, the Company will be required to settle such obligations, in whole or in part, in cash amounts as calculated pursuant to the terms of those securities. The Board considered the considerable dilution in settling these securities and obligations in shares of common stock would have on current stockholders, but given the Company’s current cash position, the Board has determined that not having the flexibility to settle the obligations in shares of common stock and perhaps having to settle those obligations, in whole or in part, in cash would potentially materially, negatively impact the Company’s business plans and not be in the best interests of the Company’s stockholders despite the dilutive effect of settling such securities and obligations in shares of common stock. To the extent our cash and cash equivalents are insufficient to enable us to make cash payments with respect to these securities and obligations and the number of shares of common stock required to settle these securities and obligations is beyond our authorized capital, if we are unable to negotiate a settlement or restructuring with the holders of such securities or obligations, we may be subject to a lawsuit or forced to declare bankruptcy. Further the holder of our debenture could foreclosure on its security interest over all our assets causing us to seek protection under federal bankruptcy laws.

If we do not increase our authorized shares of Common Stock, we may be unable to conduct further offerings of our equity securities to raise additional capital to meet our capital requirements and continue operations long enough to close the Merger.

If we do not increase our authorized shares of Common Stock, we will have insufficient available shares to meet our obligations to close the Merger, including conducting an equity financing, and issue the “merger consideration” pursuant thereto. If we do not close the Merger, we will likely lose our listing on the Nasdaq Stock Exchange.

What dilutive effect will the Authorized Share Increase have?

If the stockholders approve the Authorized Share Increase, the Board may cause the issuance of additional shares of common stock without further vote of the stockholders of the Company, except as provided under Nevada corporate law or under the rules of any national securities exchange or automated quotation system on which shares of common stock of the Company are then quoted, listed or traded. The relative voting and other rights of holders of the common stock will not be altered by the authorization of additional shares of common stock. Each share of common stock will continue to entitle its owner to one vote. When issued, the additional shares of common stock authorized by the amendment will have the same rights and privileges as the shares of common stock currently authorized and outstanding.

Issuance of significant numbers of additional shares of the Company’s common stock in the future (i) will dilute current stockholders’ percentage ownership, (ii) if such shares are issued at prices below what current stockholders’ paid for their shares, will dilute the value of current stockholders’ shares and (iii) by reducing the percentage of equity of the Company owned by present stockholders, would reduce such present stockholders’ ability to influence the election of directors or any other action taken by the holders of common stock and (iv) issuance of a material number of shares of common stock could create downward pressure on the per share price of the common stock, thereby further diminishing the value of stockholders’ shares of common stock.

11

If the Authorized Share Increase is approved, our stockholders will likely experience significant dilution as a result of shares of common stock issued pursuant to our outstanding convertible notes and the debenture, as described above. For the convertible debt, while the Company does not currently have any agreements with the holders of such convertible debt to settle the face value of such securities in shares, if the entire approximately $3.1 million in face value of convertible notes was converted into shares of common stock at $0.6910 per share (the closing price per share on April 11, 2024 as reported on The Nasdaq Capital Market), then the Company would issue approximately 4.4 million shares of common stock. Based on 9,000,000, shares of common stock outstanding as of April 11, 2024, this would result in approximately 33% dilution to existing stockholders.

Further, in relation to the debenture with Centurion, we do not currently have an agreement with Centurion to convert any portion thereof into shares of common stock and we do not anticipate that a significant amount of the approximately $8 million in face value of the debenture would be settled in shares of common stock, however, if any portion thereof is ultimately settled in shares of common stock it could have a substantial dilutive effect on stockholders. If the entire $11 million face value of the debenture were converted into shares of common stock at $0.6910 per share (the closing price per share on April 11, 2024 as reported on The Nasdaq Capital Market), then the Company would issue approximately 15.9 million shares of common stock. Based on 9,000,000, shares of common stock outstanding as of April 11, 2024, this would result in approximately 64% dilution to existing stockholders and when combined with the dilutive effect of the conversion of convertible notes described above would result in approximately 69% dilution to existing stockholders.

Further, based upon the terms of the Merger Agreement, we must reduce our outstanding liabilities to no more than $500,000 including trade accounts payable. To settle the balance of trade accounts payable in common shares, we anticipate that up to approximately $7.0 million will need to be converted into shares of common stock, based on $0.6910 per share (the closing price per share on April 11, 2024, as reported on The Nasdaq Capital Market), this would require the Company to issue approximately 10.1 million shares of common stock. Based on 9,000,000, shares of common stock outstanding as of April 11, 2024, this would result in approximately 53% dilution to existing stockholders and when combined with the dilutive effect of the conversion of convertible notes and the conversion of the Centurion debt described above would result in approximately 77% dilution to existing stockholders.

Further, we do need to raise additional capital and anticipate that we will do so through the issuance of equity or convertible debt securities. The Authorized Share Increase will increase the total number of authorized shares of common stock. As a result, we would have a larger number of authorized but unissued shares from which to issue additional shares of common stock, or securities convertible or exercisable into shares of common stock, in equity or convertible debt financing transactions to meet our capital requirements. Pursuant to the Merger Agreement, we are required to raise $2.5 million prior to the closing of the Merger. Based on an issuance price of $0.6910 per share (the closing price per share on April 11, 2024, as reported on The Nasdaq Capital Market), then the Company would issue approximately 3.6 million shares of common stock. Based on 9,000,000 share of common stock outstanding as of April 11, 2024, this would result in approximately 29% dilution and when combined with the dilutive effect of the conversion of convertible notes, the conversion of the Centurion debt, and settlement of trade accounts payable, described above would result in approximately 79% dilution to existing stockholders.

Further, we recenlty issued a $1 million convertible note to Danam in connection with a waiver and amendment of the Merger Agreement. The convertible note is not convertible unless and until stockholders approve an authorized share increase. The Authorized Share Increase will permit the convertible note to be convertible into approximately 1.8 million shares of common stock. Based on 9,000,000 shares of common stock outstanding as of April 11, 2024, this would result in approximately 17% dilution to existing stockholders and when combined with the dilutive effect of the conversion of convertible notes, the conversion of the Centurion debt, and settlement of trade accounts payable and the $2.5 million equity financing described above would result in approximately 80% dilution to existing stockholders.

If the Authorized Share Increase is approved and the stockholders of the Company approve the Merger at the special meeting to be called for approval of the Merger and related matters, as to be described in a registration statement on Form S-4 the Company intends to file in relation to the issuance of shares of common stock pursuant to the Merger to the stockholders of Danan, the Company will use the additional authorized shares of common stock to issue the “merger consideration” to stockholders of Danam. The stockholders of the Company will have a separate chance to vote on the Merger and the transactions related thereto at the special meeting called for that purpose.

Based on 9,000,000 shares of common stock currently outstanding, prior to giving effect to the reverse stock split that may be effected prior to closing the Merger, pursuant to the terms of the Merger Agreement, if the Authorized Shares Increase is approved and the stockholders of the Company approve the Merger, the Company would issue approximately 90 million shares of common stock as “merger consideration” to stockholders of Danam. Based on 9,000,000 shares of common stock issued and outstanding as of April 11, 2024, this would result in approximately 91% dilution to existing stockholders. Assuming we issue shares of common stock upon the conversion of convertible notes, the conversion of the Centurion debt, settlement of trade accounts payable, the $2.5 million equity financing and the conversion of the convertible note issued to Danam as described above we would have approximately 44.7 million shares issued and outstanding prior to the Merger and prior to giving effect to the reverse stock split that would be effected prior to closing the Merger. This would result in the issuance of approximately 402 million shares of common stock to Danam and would result in approximately 98% dilution to existing stockholders.

If the stockholders approve the Authorized Share Increase, does the Company have plans for future issuances of shares of Common Stock?

In addition to the issuance of shares of common stock upon settlement of convertible notes, our debenture with Centurion, our tade accounts payable and our convertible note with Danam, as described above, and for settlement of current securities of the Company, as discussed above, given the Company’s current available capital, its cash and cash equivalents, its history of operating at a loss and its need for additional capital to implement its plan of operations, the Company currently anticipates that will be required to commence an offering of its equity or convertible debt securities in the near future. Additionally, the Company is required to raise $2.5 million prior to the closing of the Merger, pursuant to the terms of the Merger Agreement. The Company also plans to issue shares as “merger consideration” upon the closing of the Merger, assuming the stockholders of the Company approve the Merger at the special meeting called for that purpose.

This Proxy Statement shall not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any offer or sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

12

Would the Authorized Share Increase have any Anti-Takeover Effects?

Although the Authorized Shares Increase is not motivated by anti-takeover concerns and is not considered by our Board to be an anti-takeover measure, the availability of additional authorized shares of common stock could enable the Board to issue shares defensively in response to a takeover attempt or to make an attempt to gain control of the Company more difficult or time-consuming. For example, shares of common stock could be issued to purchasers who might side with management in opposing a takeover bid that the Board determines is not in the best interests of our stockholders, thus diluting the ownership and voting rights of the person seeking to obtain control of the Company. In certain circumstances, the issuance of common stock without further action by the stockholders may have the effect of delaying or preventing a change in control of the Company, may discourage bids for our common stock at a premium over the prevailing market price and may adversely affect the market price of our common stock. As a result, increasing the authorized number of shares of our common stock could render more difficult and less likely a hostile takeover of the Company by a third-party, or a tender offer or proxy contest, assumption of control by a holder of a large block of our stock, and the possible removal of our incumbent management. Outside of the Merger pursuant to the Merger Agreement, we are not aware of any proposed attempt to take over the Company or of any present attempt to acquire a large block of our common stock.

Does the Board recommend approval of the Authorized Share Increase?

Yes. After considering the entirety of the circumstances, the Board has unanimously concluded that the Authorized Share Increase is in the best interests of the Company and its stockholders and the Board unanimously recommends that the Company’s stockholders vote in favor of the Authorized Share Increase.

What amendment is being made to the Articles of Incorporation?

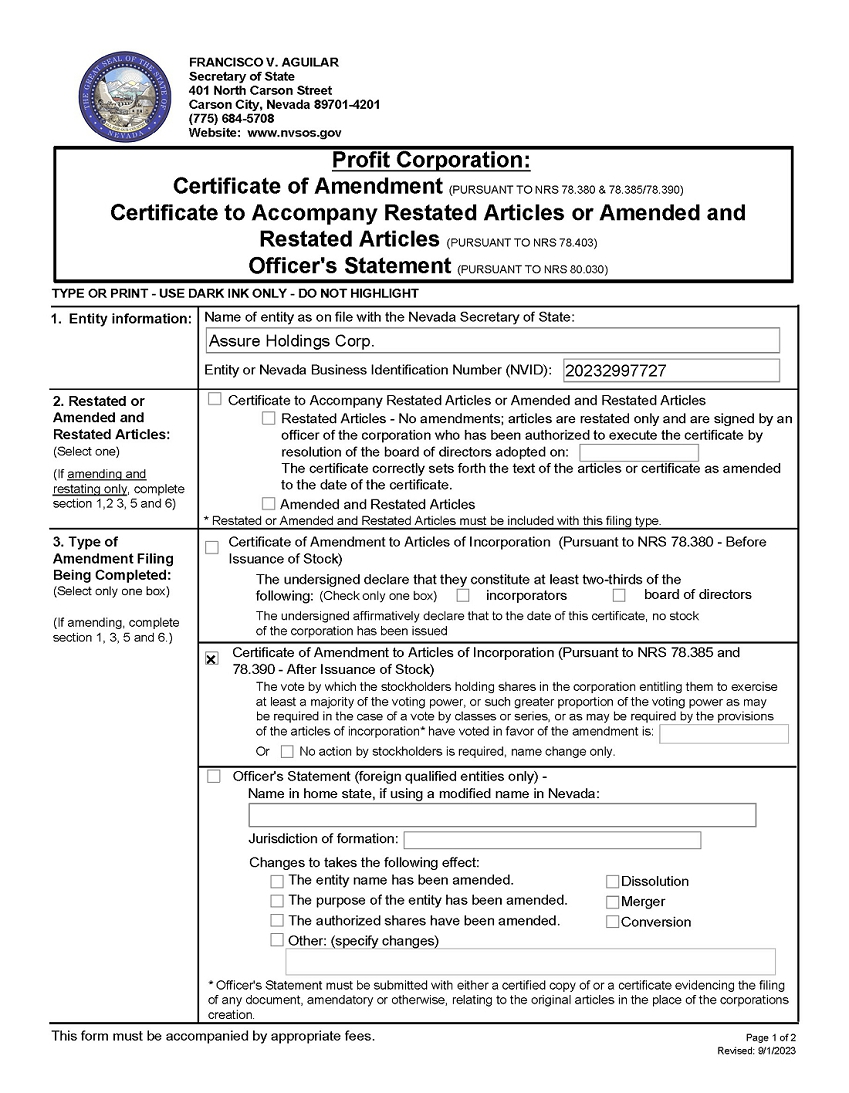

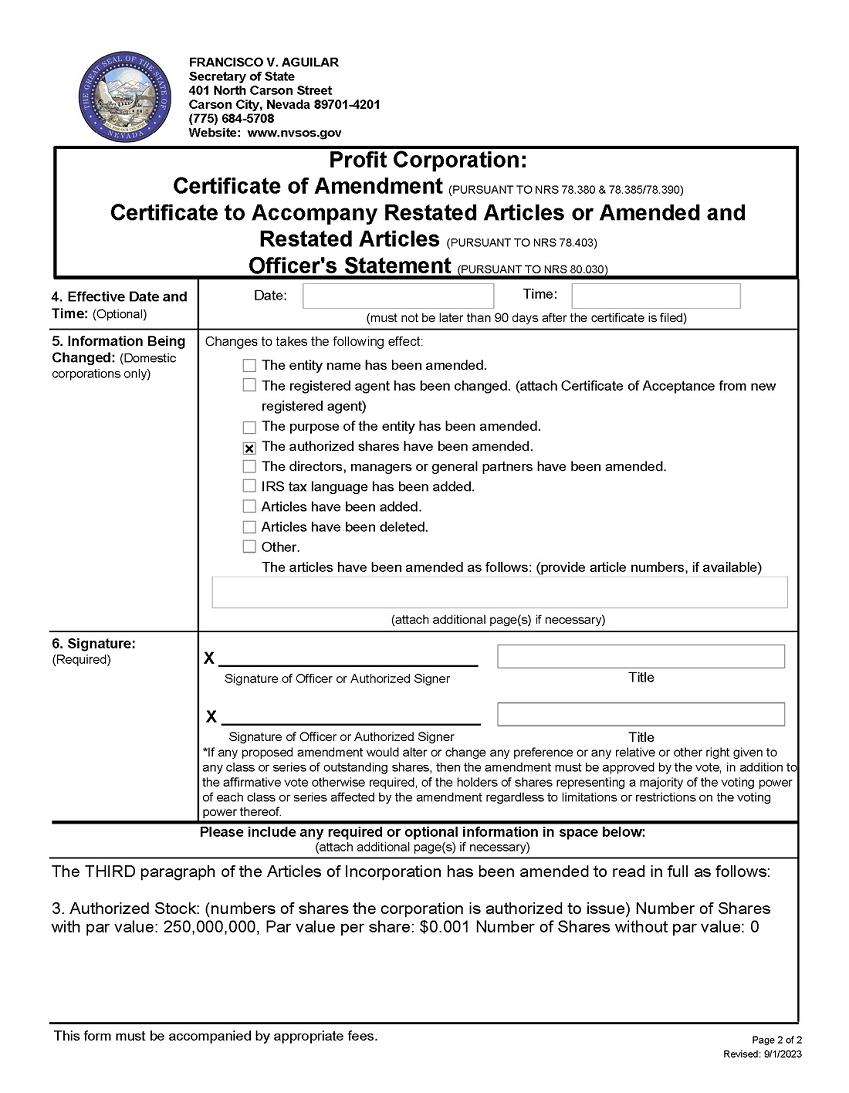

The THIRD paragraph of the Articles of Incorporation which currently reads as follows:

“3. Authorized Stock: (numbers of shares the corporation is authorized to issue) Number of Shares with par value: 9,000,000, Par value per share: $0.001 Number of Shares without par value: 0”

will be amended to read as follows:

“3. Authorized Stock: (numbers of shares the corporation is authorized to issue) Number of Shares with par value: 250,000,000, Par value per share: $0.001 Number of Shares without par value: 0”

The Certificate of Change to the Articles of Incorporation is attached hereto as Appendix B.

When will the amendment be made?

If our shareholders approve the Authorized Share Increase at the Special Meeting, we will file the amendment to our Certificate of Change with the office of the Secretary of State of Nevada to implement the increase in the authorized number of shares of common stock as soon as practicable following the Special Meeting. Upon approval and following such filing with the Secretary of State of Nevada, the amendment will become effective on the date it is filed.

Additional Information and Where to Find It

This proxy statement may be deemed to be solicitation material with respect to the Merger between Assure and Danam. In connection with the Merger, Assure intends to file relevant materials with the United States Securities and Exchange Commission, or the SEC, including a registration statement on Form S-4 that will contain a prospectus and a proxy statement. Assure will mail the proxy statement/prospectus to the Assure and Danam stockholders, and the securities may not be sold or exchanged until the registration statement becomes effective.

Investors and securityholders of Assure and Danam are urged to read these materials when they become available because they will contain important information about Assure, Danam and the Merger. This communication is not a substitute for the registration statement, definitive proxy statement/prospectus or any other documents that Assure may file with the SEC or send to securityholders in connection with the Merger. Investors and securityholders may obtain free copies of the documents filed with the SEC, once available, on Assure’s website at www.assureneuromonitoring.com, on the SEC’s website at www.sec.gov or by directing a request to Assure at 7887 E. Belleview Ave., Suite 240, Denver, Colorado, USA 80111, Attention: John Farlinger, Chief Executive Officer; or by email at ir@assureiom.com.

13

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the Solicitation

Each of Assure and Danam and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Assure in connection with the Merger. Information about the executive officers and directors of Assure are set forth in Assure’s Definitive Proxy Statement on Schedule 14A relating to the 2023 Annual Meeting of Stockholders of Assure, filed with the SEC on December 5, 2023. Other information regarding the interests of such individuals, who may be deemed to be participants in the solicitation of proxies for the stockholders of Assure will be set forth in the proxy statement/prospectus, which will be included in Assure’s registration statement on Form S-4 when it is filed with the SEC. You may obtain free copies of these documents as described above.

Required Vote of Stockholders

The affirmative vote of the holders of a majority of the outstanding common stock is required to amend our Articles of Incorporation to effect the Authorized Share Increase. Failures to vote, abstentions and broker “non-votes”, if any, will be the equivalent of a vote AGAINST this proposal.

IF OUR STOCKHOLDERS DO NOT APPROVE THE AUTHORIZED SHARE INCREASE, THE BOARD BELIEVES THAT THE LONG-TERM FINANCIAL VIABILITY OF THE COMPANY COULD BE THREATENED DUE TO (I) OUR INABILITY TO SETTLE OUR OBLIGATIONS UNDER THE CONVERTIBLE NOTES AND THE DEBENTURE AND (II) THE COMPANY’S INABILITY TO CONSUMMATE FUTURE EQUITY OFFERINGS TO MEET ITS ONGOING EXPENSES. SOME OF THESE CONSEQUENCES MAY BE MITIGATED IF THE AUTHORIZED SHARE INCREASE IS APPROVED AND IMPLEMENTED.

THE BOARD RECOMMENDS A VOTE “FOR” THE AUTHORIZED SHARE INCREASE

14

PROPOSAL 2 -APPROVAL TO ADJOURN MEETING TO SOLICIT ADDITIONAL PROXIES

If at the Special Meeting, the number of shares entitled to vote present or represented and voting in favor of Proposal 1 is insufficient to approve such proposal, the Company would like the discretionary authority from our stockholders so that the Company has the ability to move to adjourn the Special Meeting solely in relation to Proposal 1 (the “Discretionary Adjournment”). In that event, you will be asked to vote upon the adjournment, postponement or continuation proposal and not on Proposal 1.

If our stockholders approve the adjournment, postponement, or continuation proposal, we could adjourn, postpone, or continue the Special Meeting in relation to Proposal 1 and any adjourned session of the Special Meeting, to use the additional time to solicit additional proxies in favor of Proposal 1 – The Authorized Share Increase. This could include the Board’s solicitation of proxies from stockholders that have previously voted against such proposal. Even if proxies representing a sufficient number of votes against Proposal 1 have been received, you are authorizing us to adjourn, postpone, or continue the Special Meeting without a vote on Proposal 1 and seek to convince the holders of those shares to change their votes to votes in favor of the approval of Proposal 1.

What am I being asked to approve?

In this proposal, we are asking you to authorize the holder of any proxy solicited by the Board of Directors the ability to call for a Discretionary Adjournment of the Special Meeting. The affirmative vote or consent of the holders of at least a majority of the votes cast at the Special Meeting is required for the approval of any such adjournment. The Board recommends the stockholders grant this discretionary authority, if necessary, to permit it to solicit approvals of the charter amendment set forth in Proposal 1, which the Board believes will benefit the Company.

THE BOARD RECOMMENDS A VOTE “FOR” THE ADJOURNMENT PROPOSAL

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth information as of April 11, 2024 regarding the beneficial ownership of our common stock by (i) those persons who are known to us to be the beneficial owner(s) of more than 5% of our common stock, (ii) each of our directors and named executive officers, and (iii) all of our directors and executive officers as a group.

Except as otherwise indicated, the beneficial owners listed in the table below possess the sole voting and dispositive power in regard to such shares and have an address of c/o Assure Holdings Corp, 7887 E. Belleview Ave., Suite 240 Denver, Colorado. As of April 11, 2024, there were 9,000,000 shares of our common stock outstanding.

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. shares of our common stock subject to options, warrants, notes or other conversion privileges currently exercisable or convertible, or exercisable within 60 days of the date of this table, are deemed outstanding for computing the percentage of the person holding such option, warrant, note, or other convertible instrument but are not deemed outstanding for computing the percentage of any other person. Where more than one person has a beneficial ownership interest in the same shares, the sharing of beneficial ownership of these shares is designated in the footnotes to this table.

On March 4, 2023, the Company effected a reverse stock split on a twenty (20) to one (1) share basis. All information regarding stock options and warrants have been updated to reflect the reverse stock split unless provided otherwise.

As of April 11, 2024, there were two stockholders holding 5% or more of the Company’s issued and outstanding shares of common stock.

| Name and Address of | Amount and nature of | |||

| Beneficial Owner | beneficial ownership | Percent of Class | ||

| John Farlinger (1) | 50,476 | *% | ||

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. | ||||

| Christopher Rumana (2) | 95,626 | *% | ||

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. | ||||

| Steven Summer (3) | 96,126 | *% | ||

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. | ||||

| John Flood (4) | 96,345 | *% | ||

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. | ||||

| Paul Webster (5) | 1,614 | *% | ||

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. | ||||

| Directors and Executive Officers as a Group (6 persons) | 340,187 | 3.8% | ||

| Brad Hemingson | 660,000 | 7.3% | ||

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. | ||||

| Robert Koppel | 459,371 | 5.1% | ||

| c/o Assure Holdings Corp,7887 East Belleview Avenue, Denver, Colorado. |

| (1) | Mr. Farlinger is CEO and Executive Chairman of Assure. Consists of 44,376 shares of common stock and 6,100 shares of common stock acquirable upon exercise of stock options (4,500 shares) and warrants (1,600 shares) within 60 days of April 11, 2024. Of the shares of common stock beneficially owned by Mr. Farlinger, 3,000 shares were issued under a restricted stock grant agreement, subject to forfeiture, such shares are fully vested. Includes options exercisable to purchases: 4,500 shares of the Company at an exercise price of $106.00 which expire on February 1, 2026. On March 4, 2020, Preston Parsons entered into a Stock Grant Amendment and Transfer Agreement, under which he agreed to transfer and distribute 17,000 Performance shares to certain employees and senior management, including Mr. Farlinger (3,000 shares). On December 29, 2020, Assure issued 3,000 shares of common stock in settlement of the Performance shares to Mr. Farlinger, subject to forfeiture under the vesting terms of a restricted stock award agreement. The restricted shares vested under the terms of the restricted stock award agreement on September 29, 2021. |

16

| (2) | Mr. Rumana is a director of Assure. Consists of 94,235 shares of common stock and 1,391 shares of common stock acquirable upon exercise of stock options (1,000 shares) and warrants (391) within 60 days of April 11, 2024. Includes options to purchase 1,000 common shares of the Company at an exercise price of $106.00 which expire on January 27, 2026, pursuant to options awarded to Dr. Rumana on January 29, 2021. As of April 11, 2024, 867 of the options granted on January 29, 2021 have vested with the balance of options vesting on February 1, 2024 and August 1. |

| (3) | Mr. Summer is a director of Assure. Consists of 93,235 shares of common stock and 2,891 shares of common stock acquirable upon exercise of stock options (2,500 shares) and warrants (391) within 60 days of April 11, 2024. Includes options to purchase (a) 1,500 common shares of the Company at an exercise price of Cdn$171.00 which expire on October 4, 2024, pursuant to options awarded to Mr. Summer on October 4, 2019 and (b) 1,000 common shares of the Company at an exercise price of $112.00 which expire on January 27, 2026, pursuant to options awarded to Mr. Summer on January 29, 2021. As of April 11, 2024, all of the 1,500 options granted on October 4, 2019 have vested and 867 of the options granted on January 29, 2021 have vested with the balance of options vesting on February 1, 2024. |

| (4) | Mr. Flood is a director of Assure. Consists of 94,845 shares of common stock held directly and 1,500 shares of common stock acquirable upon exercise of stock options within 60 days of April 11, 2024. Includes options to purchase 1,500 common shares of the Company at an exercise price of $112.00 which expire on April 15, 2026, pursuant to options awarded to Mr. Flood on April 15, 2021. As of April 11, 2024, all of the 1,500 options granted on April 15, 2021, \have vested. |

| (5) | Mr. Webster was appointed interim CFO on November 21, 2023. Consists of 1,614 shares of common stock acquirable upon exercise of stock options 60 days from April 11, 2024. Includes options exercisable to purchase (a) 750 common shares of the Company at an exercise price of $106.00 which expire on January 27, 2026, pursuant to options awarded to Mr. Webster on January 29, 2021, (b) 500 shares of the Company at an exercise price of $153.00 which expire on October 1, 2026 pursuant to options award to Mr. Webster on October 1, 2021 and (c) 500 common shares of the Company at an exercise price of $128 which expire on October 4, 2024, pursuant to options awarded to Mr. Webster on October 4, 2021. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

No director, executive officer, stockholder holding at least 5% of shares of our common stock, or any family member thereof, had any material interest, direct or indirect, in any transaction, or proposed transaction since the beginning of the year ended December 31, 2022, in which the amount involved in the transaction exceeded or exceeds the lesser of $120,000 or one percent of the average of our total assets at year-end for the years ended December 31, 2023 and 2022.

17

In November 2022, we entered into common stock purchase agreements, pursuant to which the Company issued 24,820 shares of common stock at a price of 12.00 per shares to certain employees, directors and consultants. Pursuant to the agreements, John Farlinger, our Chairman and Chief Executive Officer, purchased 3,531 shares of common stock, and John Price, our former Chief Financial Officer, purchased 4,071 shares of common stock.

Policies and Procedures for the Review, Approval, or Ratification of Related Transactions

We have a policy for the review of transactions with related persons as set forth in our Audit Committee Charter and internal practices. The policy requires review, approval or ratification of all transactions in which we are a participant and in which any of our directors, executive officers, significant stockholders or an immediate family member of any of the foregoing persons has a direct or indirect material interest, subject to certain categories of transactions that are deemed to be pre-approved under the policy - including employment of executive officers, director compensation (in general, where such transactions are required to be reported in our proxy statement pursuant to SEC compensation disclosure requirements), as well as certain transactions where the amounts involved do not exceed specified thresholds. All related party transactions must be reported for review by the Audit Committee of the Board pursuant to the Audit Committee’s charter.

Following its review, the Audit Committee determines whether these transactions are in, or not inconsistent with, the best interests of the Company and its stockholders, taking into consideration whether they are on terms no less favorable to the Company than those available with other parties and the related person’s interest in the transaction. If a related party transaction is to be ongoing, the Audit Committee may establish guidelines for the Company’s management to follow in its ongoing dealings with the related person.

Our policy for review of transactions with related persons was followed in all of the transactions set forth above and all such transactions were reviewed and approved in accordance with our policy for review of transactions with related persons.

As of the date of this Proxy Statement, management does not know of any other matter that will come before the meeting.

Where You Can Find More Information

We file annual and quarterly reports and other reports and information with the SEC. These reports and other information can be inspected and copied at, and copies of these materials can be obtained at prescribed rates from, the Public Reference Section of the Securities and Exchange Commission, Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. 20549-1004. We distribute to our stockholders annual reports containing financial statements audited by our independent registered public accounting firm and, upon request, quarterly reports for the first three quarters of each fiscal year containing unaudited financial information. In addition, the reports and other information are filed through Electronic Data Gathering, Analysis and Retrieval (known as “EDGAR”) system and are publicly available on the SEC’s site on the Internet, located at www.sec.gov. We will provide without charge to you, upon written or oral request, a copy of the reports and other information filed with the SEC.

Any requests for copies of information, reports or other filings with the SEC should be directed to the Company’s Secretary at Assure Holdings Corp., 7887 E. Belleview Ave., Suite 240, Denver, Colorado, USA 80111.

18

Cautionary Statements Regarding Forward-Looking Statements

This proxy statement contains forward-looking statements based upon the current expectations of Assure and Danam. Forward-looking statements involve risks and uncertainties and include, but are not limited to, statements about the structure, timing and completion of the proposed transactions; the listing of the combined company on Nasdaq after the closing of the proposed merger; expectations regarding the ownership structure of the combined company after the closing of the proposed merger; the expected executive officers and directors of the combined company; the expected cash position of each of Assure and Danam and the combined company at the closing of the proposed merger; the future operations of the combined company; and other statements that are not historical fact. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation: (i) the risk that the conditions to the closing of the proposed transaction are not satisfied, including the failure to timely obtain stockholder approval for the transaction, if at all; (ii) uncertainties as to the timing of the consummation of the proposed transaction and the ability of each of Assure and Danam to consummate the proposed merger, as applicable; (iii) risks related to Assure’s ability to manage its operating expenses and its expenses associated with the proposed transactions pending closing; (iv) risks related to the failure or delay in obtaining required approvals from any governmental or quasi-governmental entity necessary to consummate the proposed transactions; (v) the risk that as a result of adjustments to the exchange ratio, Assure stockholders and Danam stockholders could own more or less of the combined company than is currently anticipated; (vi) risks related to the market price of Assure’s common stock; (vii) unexpected costs, charges or expenses resulting from either or both of the proposed transaction; (viii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transactions; (ix) risks related to the inability of the combined company to obtain sufficient additional capital to continue to advance its business plan; and (x) risks associated with the possible failure to realize certain anticipated benefits of the proposed transactions, including with respect to future financial and operating results. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully described in periodic filings with the SEC, including the factors described in the section titled “Risk Factors” in Assure’s Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 filed with the SEC, and in other filings that Assure makes and will make with the SEC in connection with the proposed transaction, including the proxy statement/prospectus described under “Additional Information and Where to Find It.” You should not place undue reliance on these forward-looking statements, which are made only as of the date hereof or as of the dates indicated in the forward-looking statements. Except as required by law, Assure expressly disclaims any obligation or undertaking to update or revise any forward-looking statements contained herein to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based.

| Appendix A | Form of Proxy Card |

| Appendix B | Articles of Amendment for Authorized Share Increase |

By Order of the Board of Directors

ASSURE HOLDINGS CORP.

| /s/ John Farlinger | |

| Executive Chairman and Chief Executive Officer |

April 16, 2024

Please sign and return the enclosed form of proxy promptly. If you decide to attend the meeting, you may, if you wish, revoke the proxy and vote your shares in person.

19

APPENDIX A – FORM OF PROXY CARD

20

| Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLY THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. V48739-S87893 For Against Abstain ! ! ! ! ! ! ASSURE HOLDINGS CORP. ASSURE HOLDINGS CORP. 7887 E BELLEVIEW AVE, SUITE 240 DENVER, CO 80111 2. To authorize the adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal No. 1 (the “Adjournment Proposal”) 1. To approve the amendment of the Company’s Articles of Incorporation, to increase the number of authorized shares (the “Authorized Share Increase”) in the Company’s common shares from 9,000,000 to 250,000,000 Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. The Board of Directors recommends you vote FOR the following proposals: VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. SCAN TO VIEW MATERIALS & VOTEw |