| 3Q’21 Earnings Call November 15, 2021 NASDAQ: IONM –TSXV: IOM |

| Cautionary Note regarding Forward-Looking Statements This presentation may contain “forward-looking statements” within the meaning of applicable securities laws. Forward-looking statements may generally be identified by the use of the words "anticipates," "expects," "intends," "plans," "should," "could," "would," "may," "will," "believes," "estimates," "potential," "target," or "continue" and variations or similar expressions. Forward-looking statements include, but are not limited to, statements regarding forecasts of managed cases and remote neurology managed cases, the potential for accretive M&A work, potential margin improvement with scale in remote neurology services, lower costs of delivery and improved quality of services from remote reurology services, potential for expansion into adjacent markets, targeted states for growth, and expansion opportunities. These statements are based upon the current expectations and beliefs of management and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These risks include risks regarding our patient volume or cases not growing as expected, or decreasing, which could impact revenue and profitability; unfavorable economic conditions could have an adverse effect on our business; risks related to increased leverage resulting from incurring additional debt; the policies of health insurance carriers may affect the amount of revenue we receive; our ability to successfully market and sell our products and services; we may be subject to competition and technological risk which may impact the price and amount of services we can sell and the nature of services we can provide; regulatory changes that are unfavorable in the states where our operations are conducted or concentrated; our ability to comply and the cost of compliance with extensive existing regulation and any changes or amendments thereto; changes within the medical industry and third-party reimbursement policies and our estimates of associated timing and costs with the same; our ability to adequately forecast expansion and the Company’s management of anticipated growth; and risks and uncertainties discussed in our most recent annual and quarterly reports filed with the United States Securities and Exchange Commission, including our annual report on Form 10-K filed on March 30, 2021, and with the Canadian securities regulators and available on the Company’s profiles on EDGAR at www.sec.gov and SEDAR at www.sedar.com, which risks and uncertainties are incorporated herein by reference. Readers are cautioned not to place undue reliance on forward-looking statements. Except as required by law, Assure does not intend, and undertakes no obligation, to update any forward-looking statements to reflect, in particular, new information or future events. Non-GAAP Financial Measures This presentation includes certain measures which have not been prepared in accordance with Generally Accepted Accounting Principals (“GAAP”) such as Adjusted EBITDA. We define EBITDA as net income/(loss) before interest expense, provision for income taxes, depreciation and amortization. We calculate Adjusted EBITDA as EBITDA further adjusted to exclude the effects of the following items: share-based compensation, gain on payroll protection program loan and gain on extinguishment of acquisition debt. We exclude share-based compensation because this represents a non-cash charge and our mix of cash and share-based compensation may differ from other companies, which effects the comparability of results of operations and liquidity. We exclude gain on payroll protection program loan and gain on extinguishment of acquisition debt because these are non-recurring items and we believe their inclusion is not representative of operating performance. Adjusted EBITDA is not an earnings measure recognized by GAAP and does not have a standardized meaning prescribed by GAAP. Management believes that Adjusted EBITDA is an appropriate measure in evaluating the Company’s operating performance. Management uses Adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes. Management believes that non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance. Readers are cautioned that Adjusted EBITDA should not be construed as an alternative to net income (as determined under GAAP), as an indicator of financial performance or to cash flow from operating activities (as determined under GAAP) or as a measure of liquidity and cash flow. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. Other companies, including companies in our industry, may calculate similarly titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. We attempt to compensate for these limitations by providing specific information regarding the GAAP items excluded from these non-GAAP financial measures. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures presented on slide and not rely on any single financial measure to evaluate our business. Key Performance Metrics This presentation contains key performance metrics that management of the Company utilizes to determine operational performance from period to period. These metrics include managed cases and remote neurology managed cases. We define managed cases as all technical cases Assure performs and any cases where the professional bill is from a 100% owned Assure entity and excludes cases when a global bill is presented and we calculate it based on bills presented during the relevant measurement period. We define remote neurology managed cases as a subset of managed cases where Assure’s remote neurology platform is utilized and billed. Management believes that managed cases and remote neurology managed cases are important measures of the Company’s operational performance because it is a consistent measurement to evaluate patient revenue streams. Disclaimer & Safe Harbor Assure Neuromonitoring | 2 |

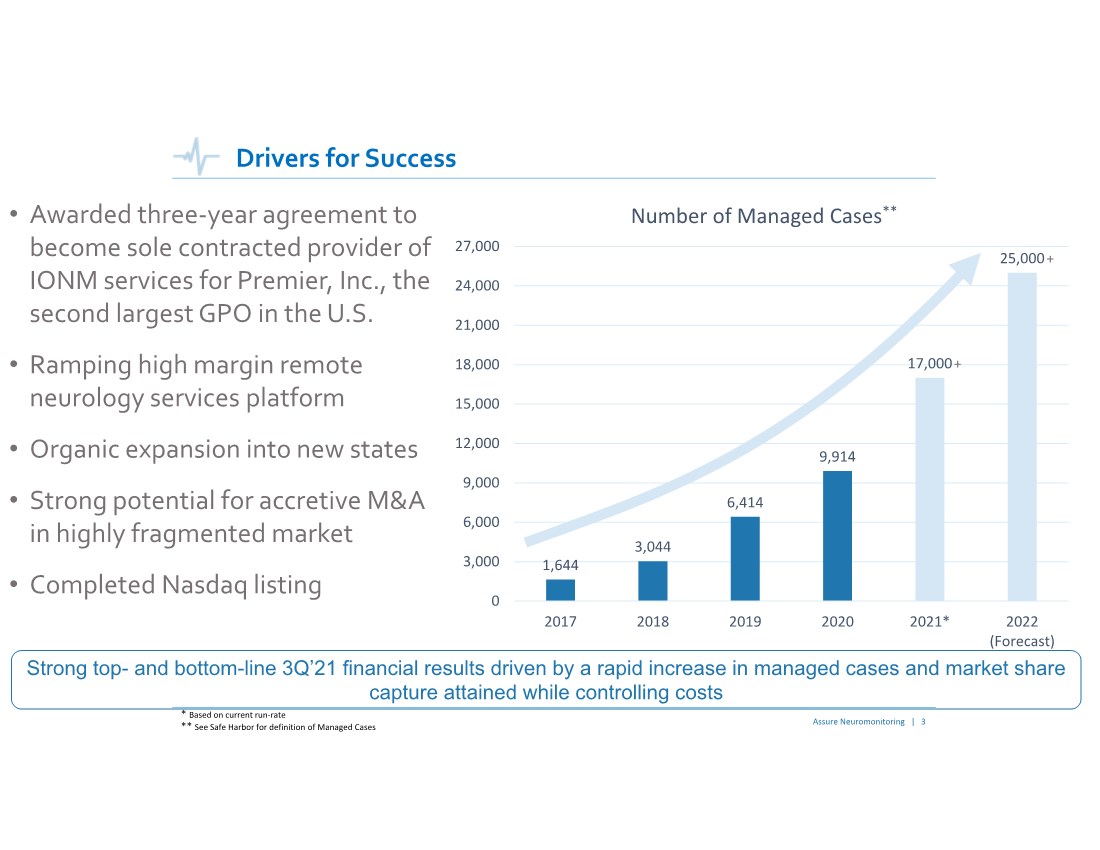

| Assure Neuromonitoring | 3 Drivers for Success • Awarded three-year agreement to become sole contracted provider of IONM services for Premier, Inc., the second largest GPO in the U.S. • Ramping high margin remote neurology services platform • Organic expansion into new states • Strong potential for accretive M&A in highly fragmented market • Completed Nasdaq listing * Based on current run-rate 1,644 3,044 6,414 9,914 17,000 25,000 0 3,000 6,000 9,000 12,000 15,000 18,000 21,000 24,000 27,000 2017 2018 2019 2020 2021* 2022 (Forecast) Number of Managed Cases** Strong top- and bottom-line 3Q’21 financial results driven by a rapid increase in managed cases and market share capture attained while controlling costs + + ** See Safe Harbor for definition of Managed Cases |

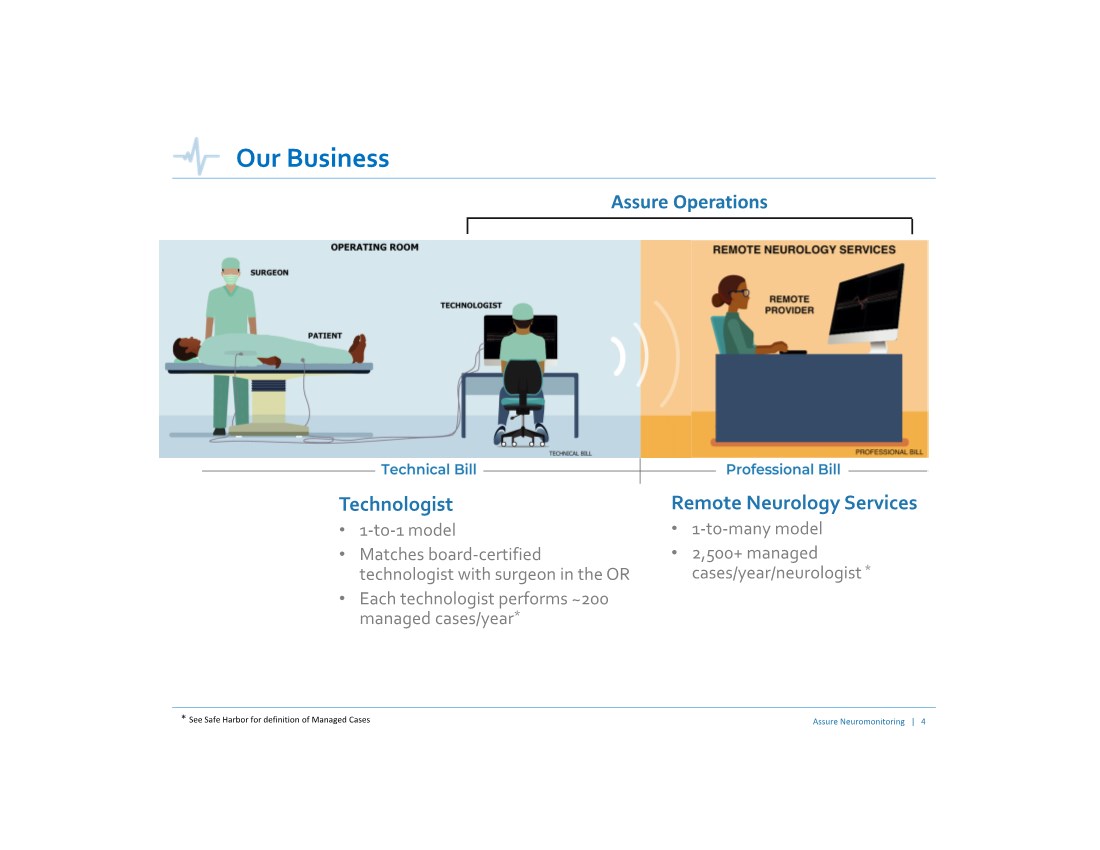

| Assure Neuromonitoring | 4 Our Business Remote Neurology Services • 1-to-many model • 2,500+ managed cases/year/neurologist * Assure Operations Technologist • 1-to-1 model • Matches board-certified technologist with surgeon in the OR • Each technologist performs ~200 managed cases/year* * See Safe Harbor for definition of Managed Cases |

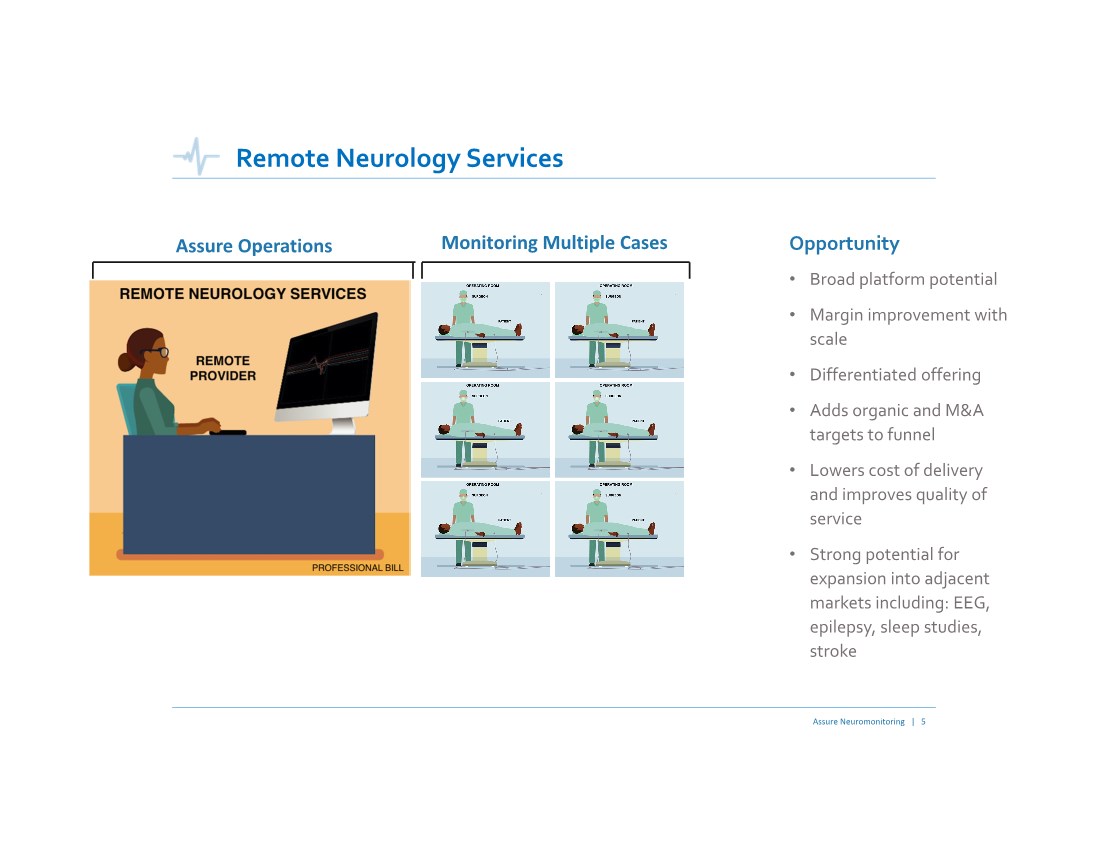

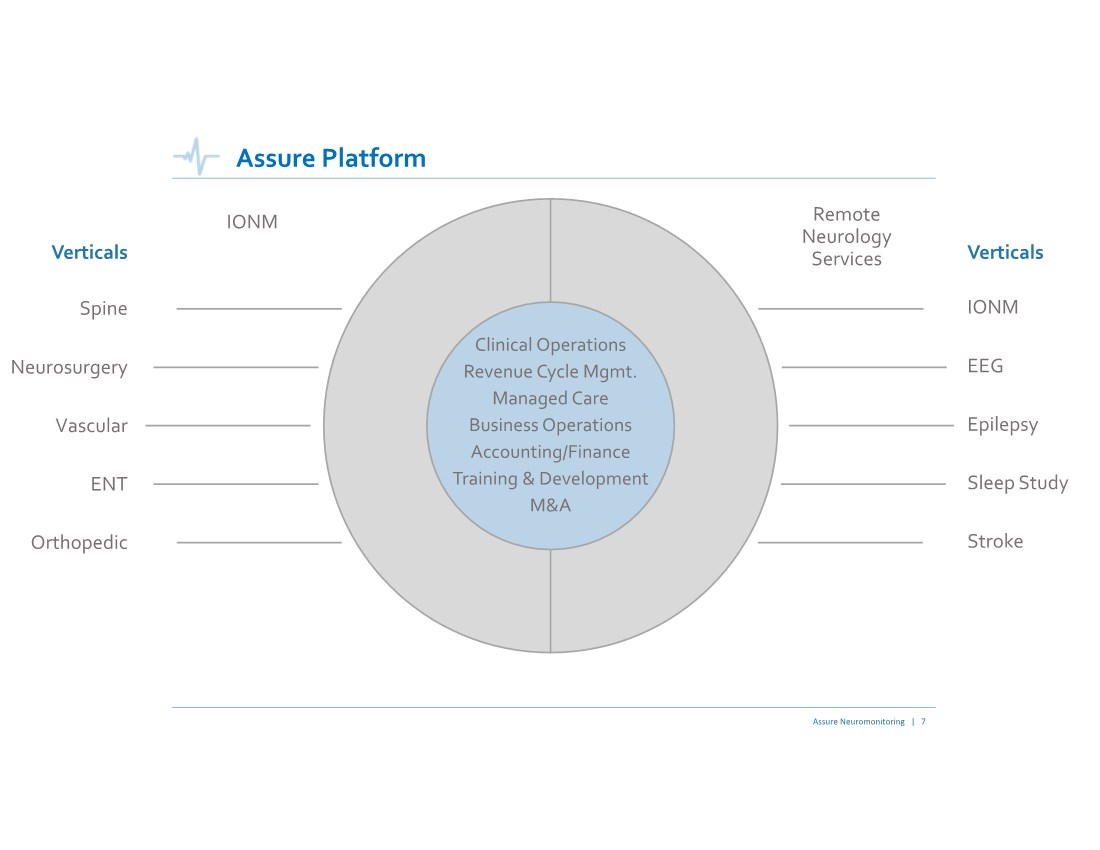

| Assure Neuromonitoring | 5 Remote Neurology Services Opportunity • Broad platform potential • Margin improvement with scale • Differentiated offering • Adds organic and M&A targets to funnel • Lowers cost of delivery and improves quality of service • Strong potential for expansion into adjacent markets including: EEG, epilepsy, sleep studies, stroke Assure Operations Monitoring Multiple Cases |

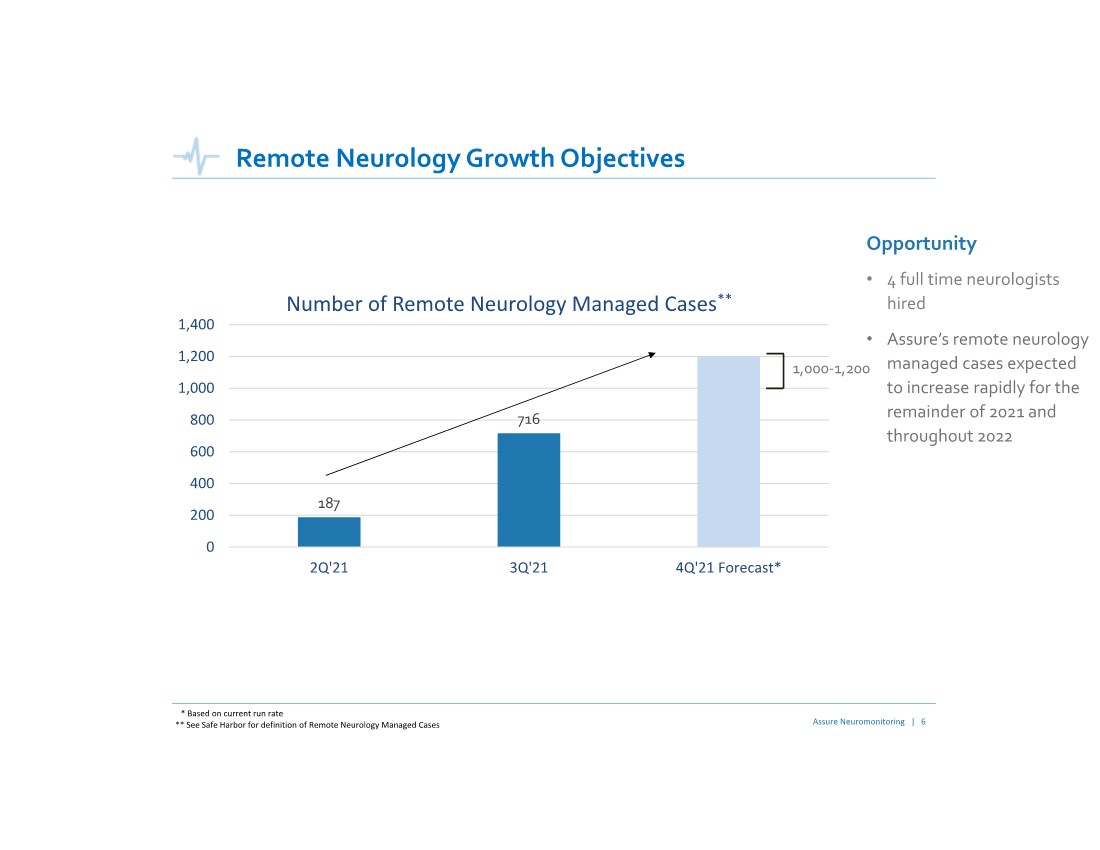

| Remote Neurology Growth Objectives * Based on current run rate 187 716 0 200 400 600 800 1,000 1,200 1,400 2Q'21 3Q'21 4Q'21 Forecast* Number of Remote Neurology Managed Cases** Opportunity • 4 full time neurologists hired • Assure’s remote neurology managed cases expected to increase rapidly for the remainder of 2021 and throughout 2022 1,000-1,200 Assure Neuromonitoring | 6 ** See Safe Harbor for definition of Remote Neurology Managed Cases |

| Assure Neuromonitoring | 7 Assure Platform Clinical Operations Revenue Cycle Mgmt. Managed Care Business Operations Accounting/Finance Training & Development M&A IONM Remote Neurology Services Spine Neurosurgery Vascular ENT Orthopedic IONM EEG Epilepsy Sleep Study Stroke Verticals Verticals |

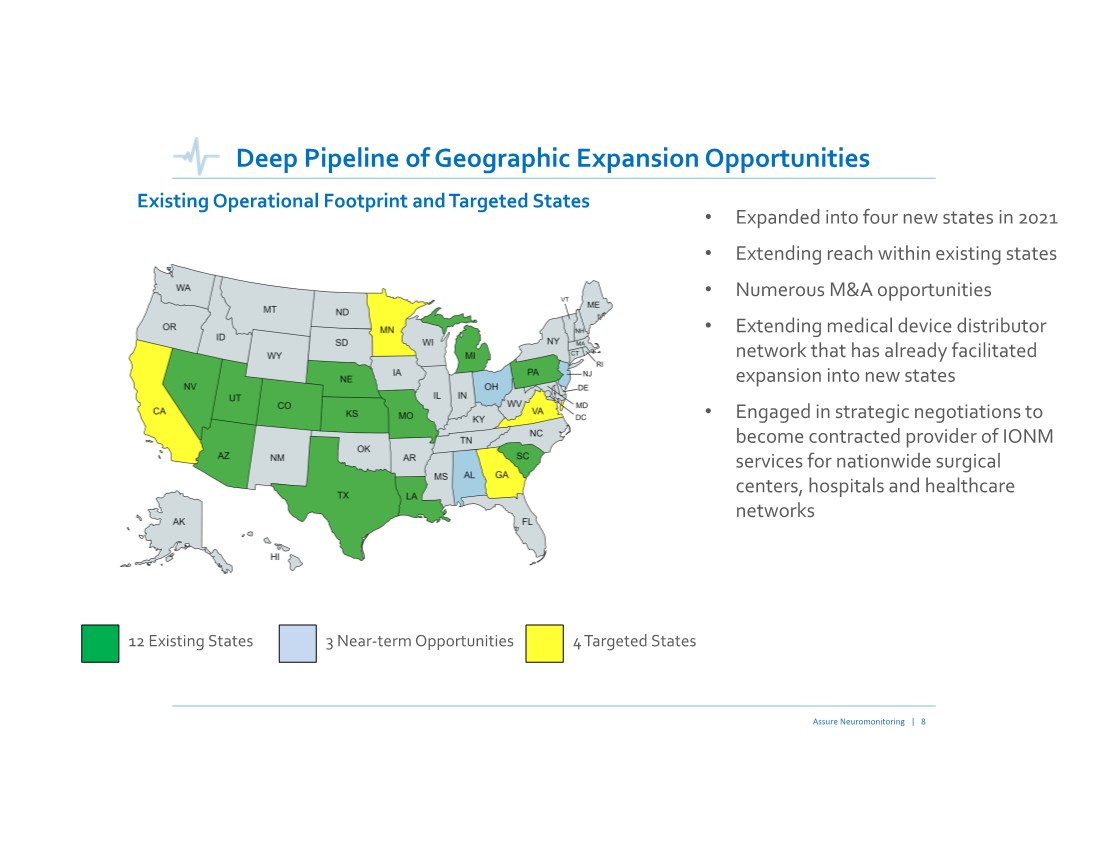

| Deep Pipeline of Geographic Expansion Opportunities Existing Operational Footprint and Targeted States • Expanded into four new states in 2021 • Extending reach within existing states • Numerous M&A opportunities • Extending medical device distributor network that has already facilitated expansion into new states • Engaged in strategic negotiations to become contracted provider of IONM services for nationwide surgical centers, hospitals and healthcare networks Assure Neuromonitoring | 8 12 Existing States 4 Targeted States 3 Near-term Opportunities |

| Sole Contracted Supplier of IONM Services for Premier, Inc. Assure Neuromonitoring | 9 Premier is the second largest Group Purchasing Organization in the U.S., uniting an alliance of more than 4,400 hospitals and approximately 225,000 other providers • Assure was awarded a 3-year agreement to become the sole contracted provider of IONM services for the Premier network • Assure competed in a competitive RFP process to win the Premier agreement • Assure’s selection was based on superior clinical care, quality of service, competitive pricing, as well as recognition that it has capacity to scale and support coverage for a large national GPO |

| Assure is the Only Publicly Traded Pure-Play IONM Company Assure Neuromonitoring | 10 |

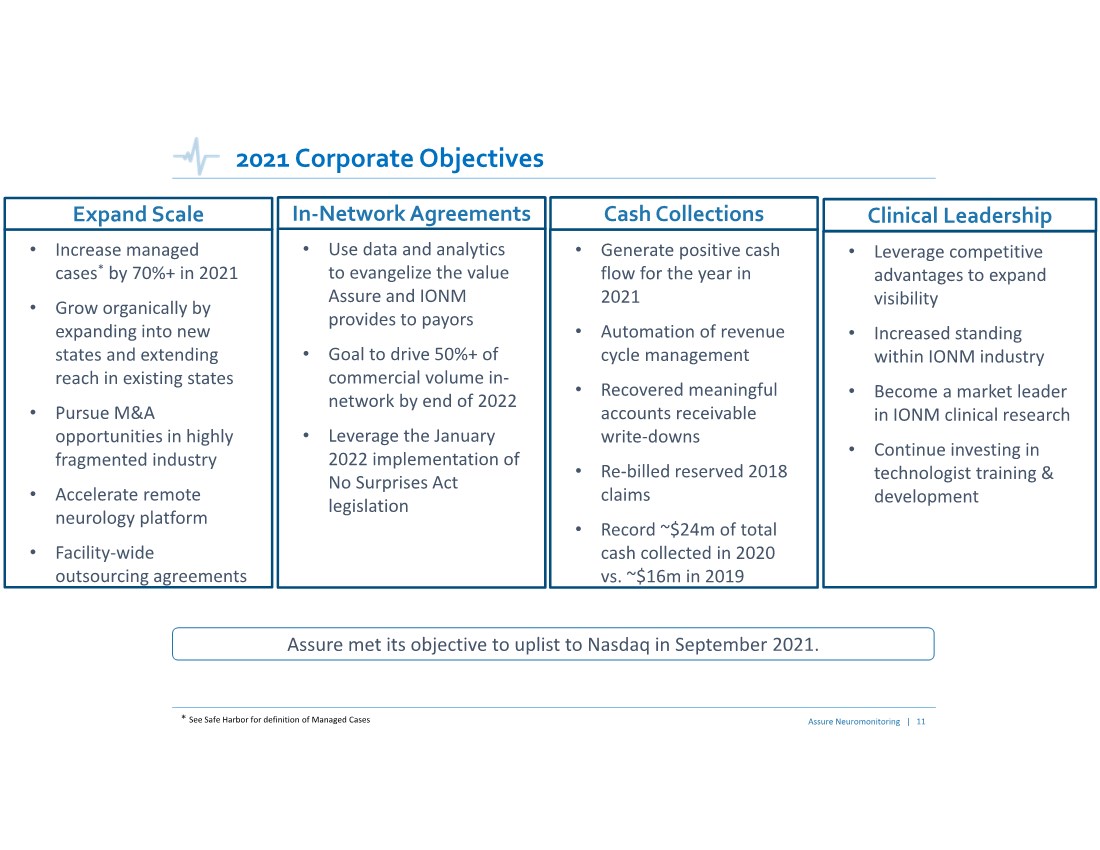

| 2021 Corporate Objectives • Increase managed cases* by 70%+ in 2021 • Grow organically by expanding into new states and extending reach in existing states • Pursue M&A opportunities in highly fragmented industry • Accelerate remote neurology platform • Facility-wide outsourcing agreements • Use data and analytics to evangelize the value Assure and IONM provides to payors • Goal to drive 50%+ of commercial volume in- network by end of 2022 • Leverage the January 2022 implementation of No Surprises Act legislation • Generate positive cash flow for the year in 2021 • Automation of revenue cycle management • Recovered meaningful accounts receivable write-downs • Re-billed reserved 2018 claims • Record ~$24m of total cash collected in 2020 vs. ~$16m in 2019 Expand Scale Assure Neuromonitoring | 11 Assure met its objective to uplist to Nasdaq in September 2021. In-Network Agreements Cash Collections • Leverage competitive advantages to expand visibility • Increased standing within IONM industry • Become a market leader in IONM clinical research • Continue investing in technologist training & development Clinical Leadership * See Safe Harbor for definition of Managed Cases |

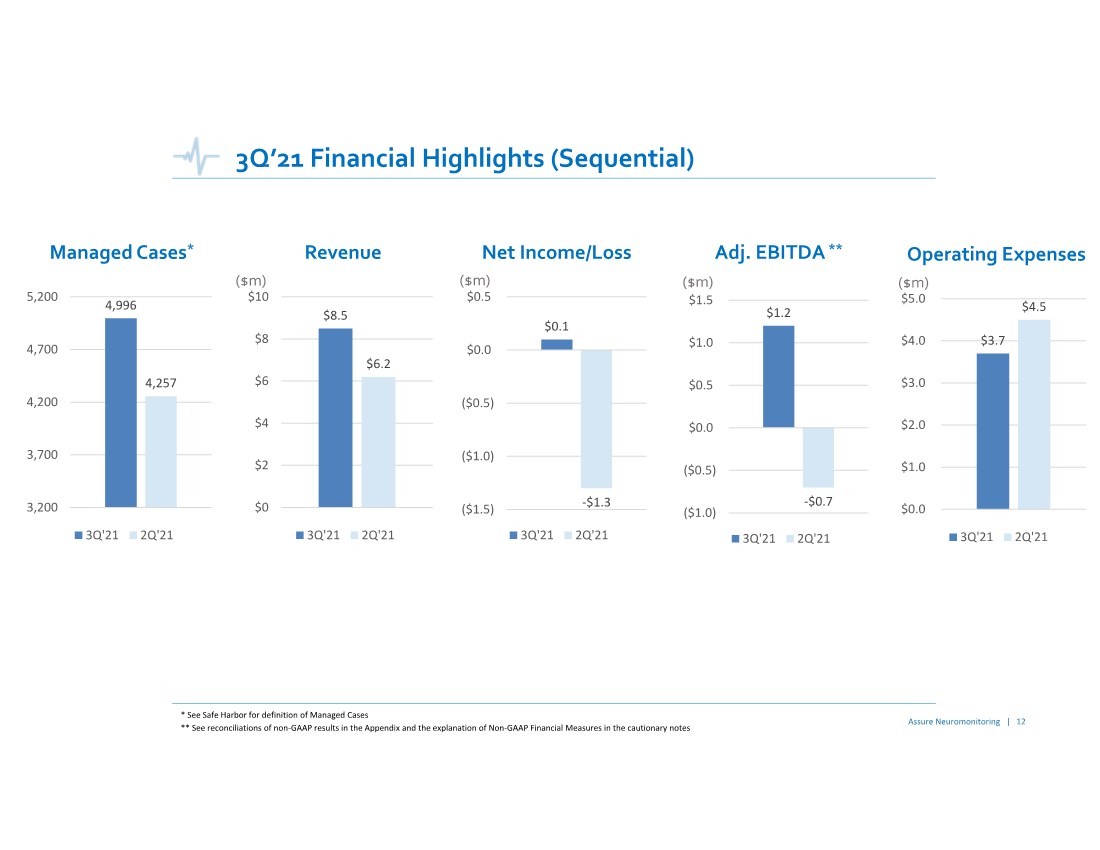

| 3Q’21 Financial Highlights (Sequential) 4,996 4,257 3,200 3,700 4,200 4,700 5,200 3Q'21 2Q'21 Managed Cases* $8.5 $6.2 $0 $2 $4 $6 $8 $10 3Q'21 2Q'21 Revenue $1.2 -$0.7 ($1.0) ($0.5) $0.0 $0.5 $1.0 $1.5 3Q'21 2Q'21 Adj. EBITDA ** $0.1 -$1.3 ($1.5) ($1.0) ($0.5) $0.0 $0.5 3Q'21 2Q'21 Net Income/Loss ($m) ($m) ($m) Assure Neuromonitoring | 12 ** See reconciliations of non-GAAP results in the Appendix and the explanation of Non-GAAP Financial Measures in the cautionary notes * See Safe Harbor for definition of Managed Cases $3.7 $4.5 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 3Q'21 2Q'21 Operating Expenses ($m) |

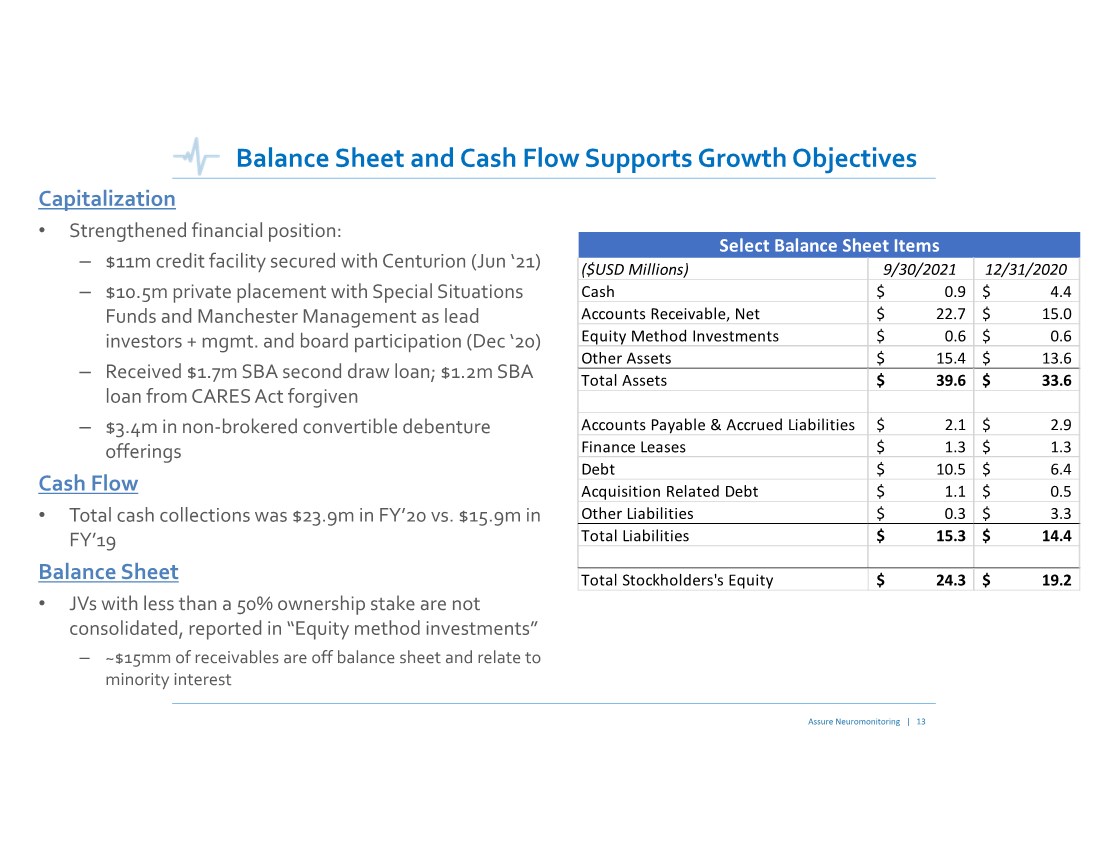

| Balance Sheet and Cash Flow Supports Growth Objectives Capitalization • Strengthened financial position: – $11m credit facility secured with Centurion (Jun ‘21) – $10.5m private placement with Special Situations Funds and Manchester Management as lead investors + mgmt. and board participation (Dec ‘20) – Received $1.7m SBA second draw loan; $1.2m SBA loan from CARES Act forgiven – $3.4m in non-brokered convertible debenture offerings Cash Flow • Total cash collections was $23.9m in FY’20 vs. $15.9m in FY’19 Balance Sheet • JVs with less than a 50% ownership stake are not consolidated, reported in “Equity method investments” – ~$15mm of receivables are off balance sheet and relate to minority interest Assure Neuromonitoring | 13 ($USD Millions) 9/30/2021 12/31/2020 Cash 0.9 $ 4.4 $ Accounts Receivable, Net 22.7 $ 15.0 $ Equity Method Investments 0.6 $ 0.6 $ Other Assets 15.4 $ 13.6 $ Total Assets 39.6 $ 33.6 $ Accounts Payable & Accrued Liabilities 2.1 $ 2.9 $ Finance Leases 1.3 $ 1.3 $ Debt 10.5 $ 6.4 $ Acquisition Related Debt 1.1 $ 0.5 $ Other Liabilities 0.3 $ 3.3 $ Total Liabilities 15.3 $ 14.4 $ Total Stockholders's Equity 24.3 $ 19.2 $ Select Balance Sheet Items |

| Q&A Assure Holdings 4600 S. Ulster St., Suite 1225 Denver, CO 80237 720-287-3093 www.assureneuromonitoring.com Company Contact John Farlinger Executive Chairman and CEO John.Farlinger@assureiom.com Investor Relations Scott Kozak Director, Investor and Media Relations Scott.Kozak@assureiom.com Assure Neuromonitoring | 14 |

| 3Q’21 Earnings Call - Appendix November 15, 2021 NASDAQ: IONM –TSXV: IOM |

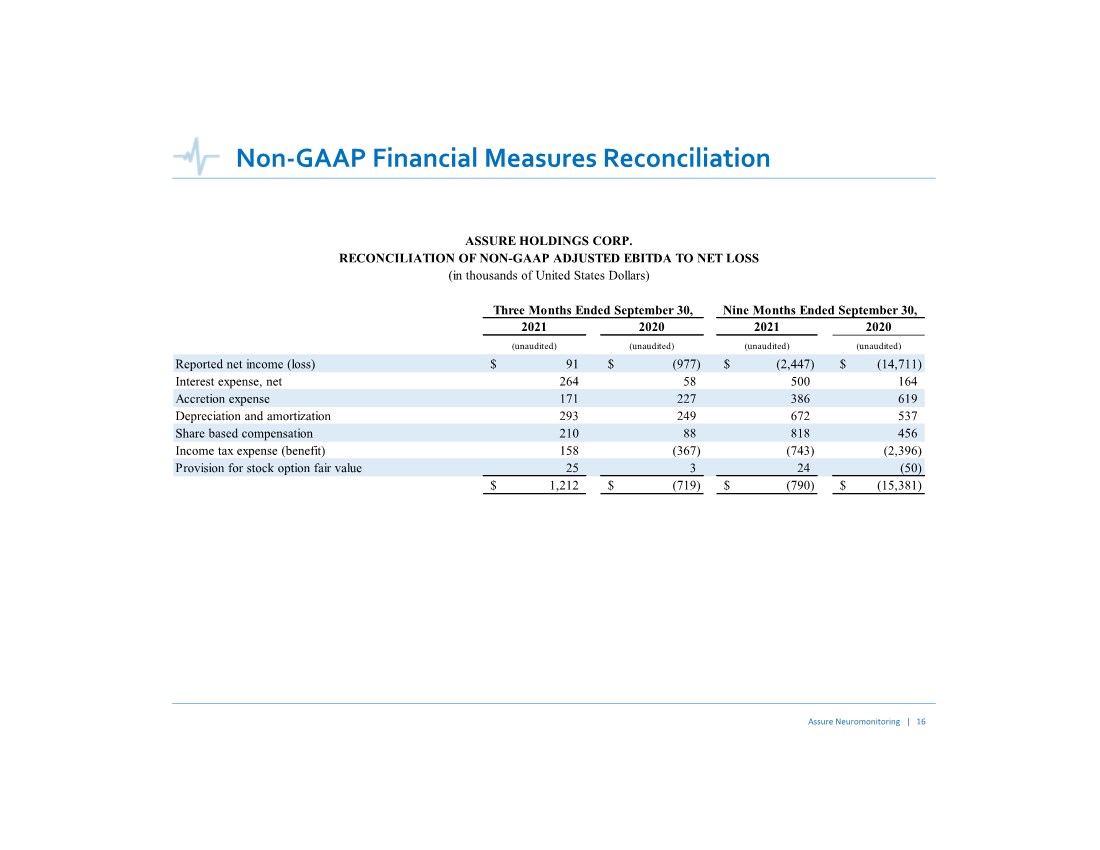

| Non-GAAP Financial Measures Reconciliation Assure Neuromonitoring | 16 2021 2020 2021 2020 (unaudited) (unaudited) (unaudited) (unaudited) Reported net income (loss) 91 $ (977) $ (2,447) $ (14,711) $ Interest expense, net 264 58 500 164 Accretion expense 171 227 386 619 Depreciation and amortization 293 249 672 537 Share based compensation 210 88 818 456 Income tax expense (benefit) 158 (367) (743) (2,396) Provision for stock option fair value 25 3 24 (50) 1,212 $ (719) $ (790) $ (15,381) $ ASSURE HOLDINGS CORP. RECONCILIATION OF NON-GAAP ADJUSTED EBITDA TO NET LOSS (in thousands of United States Dollars) Nine Months Ended September 30, Three Months Ended September 30, |