| Second Quarter 2022 ResultsAugust 15, 2022 NASDAQ: IONM |

| Cautionary Note regarding Forward‐Looking StatementsThis presentation may contain “forward‐looking statements” within the meaning of applicable securities laws. Forward‐looking statements may generally be identified by the use of the words "anticipates," "expects," "intends," "plans," "should," "could," "would," "may," "will," "believes," "estimates," "potential," "target," or "continue" and variations or similar expressions. Forward‐looking statements include, but are not limited to, statements regarding forecasts of managed cases and remote neurology managed cases, the effect of cost reductions and projected savings, financial projections, including the company being Adjusted EBITDA and cash flow positive in the second half of 2022, and other similar statements. These statements are based upon the current expectations and beliefs of management and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward‐looking statements. These risks include risks regarding our patient volume or cases not growing as expected, or decreasing, which could impact revenue and profitability; unfavorable economic conditions could have an adverse effect on our business; risks related to increased leverage resulting from incurring additional debt; the policies of health insurance carriers may affect the amount of revenue we receive; our ability to successfully market and sell our products and services; we may be subject to competition and technological risk which may impact the price and amount of services we can sell and the nature of services we can provide; regulatory changes that are unfavorable in the states where our operations are conducted or concentrated; our ability to comply and the cost of compliance with extensive existing regulation and any changes or amendments thereto; changes within the medical industry and third‐party reimbursement policies and our estimates of associated timing and costs with the same; our ability to adequately forecast expansion and the Company’s management of anticipated growth; and risks and uncertainties discussed in our most recent annual and quarterly reports filed with the United States Securities and Exchange Commission, including our annual report on Form 10‐K filed on March 14, 2022, and with the Canadian securities regulators and available on the Company’s profiles on EDGAR at www.sec.govand SEDAR at www.sedar.com, which risks and uncertainties are incorporated herein by reference. Readers are cautioned not to place undue reliance on forward‐looking statements. Except as required by law, Assure does not intend, and undertakes no obligation, to update any forward‐looking statements to reflect, in particular, new information or future events.Non‐GAAP Financial MeasuresThis presentation includes certain measures which have not been prepared in accordance with Generally Accepted Accounting Principals (“GAAP”) such as Adjusted EBITDA. We define EBITDA as net income/(loss) before interest expense, provision for income taxes, depreciation and amortization. We calculate Adjusted EBITDA as EBITDA further adjusted to excludethe effects of the following items: share‐based compensation, gain on payroll protection program loan and gain on extinguishment of acquisition debt. We exclude share‐based compensation because this represents a non‐cash charge and our mix of cash and share‐based compensation may differ from other companies, which effects the comparability of results of operations and liquidity. We exclude gain on payroll protection program loan and gain on extinguishment of acquisition debt because these are non‐recurring items and we believe their inclusion is not representative of operating performance. Adjusted EBITDA is not an earnings measure recognized by GAAP and does not have a standardized meaning prescribed by GAAP. Management believes that Adjusted EBITDA is an appropriate measure in evaluating the Company’s operating performance. Management uses Adjusted EBITDA to evaluate our ongoing operations and for internal planningand forecasting purposes. Management believes that non‐GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance. Readers are cautioned that Adjusted EBITDA should not be construed as an alternative to net income (as determined under GAAP), as an indicator of financial performance or to cash flow from operating activities (as determined under GAAP) orasa measure of liquidity and cash flow. Investors are cautioned that there are material limitations associated with the use of non‐GAAP financial measures as an analytical tool. Other companies, including companies in our industry, may calculate similarly titled non‐GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non‐GAAP financial measures as tools for comparison. We attempt to compensate for these limitations by providing specific information regarding the GAAP items excluded from these non‐GAAP financial measures. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non‐GAAP financial measures to their most directly comparable GAAP financial measures presented on slide and not rely on any single financial measure to evaluate our business.Key Performance MetricsThis presentation contains key performance metrics that management of the Company utilizes to determine operational performance from period to period. These metrics include managed cases and remote neurology managed cases. We define managed cases as all technical cases Assure performs and any cases where the professional bill is from a 100% owned Assure entity and excludes cases when a global bill is presented and we calculate it based on bills presented during the relevant measurement period. We define remote neurology managed cases as a subset of managed cases where Assure’s remote neurology platform is utilized and billed. Management believes that managed cases and remote neurology managed cases are important measures of the Company’s operational performance because it is a consistent measurement to evaluatepatient revenue streams. Disclaimer & Safe HarborAssure Neuromonitoring | 2 |

| Assure Neuromonitoring | 3 2Q’22 Earnings Call Agenda•Recent corporate developments•Revenue cycle management •Actions to improve profitability•Cash receipts•2Q’22 financial summary•Accounts receivable trends•2H’22 expectations |

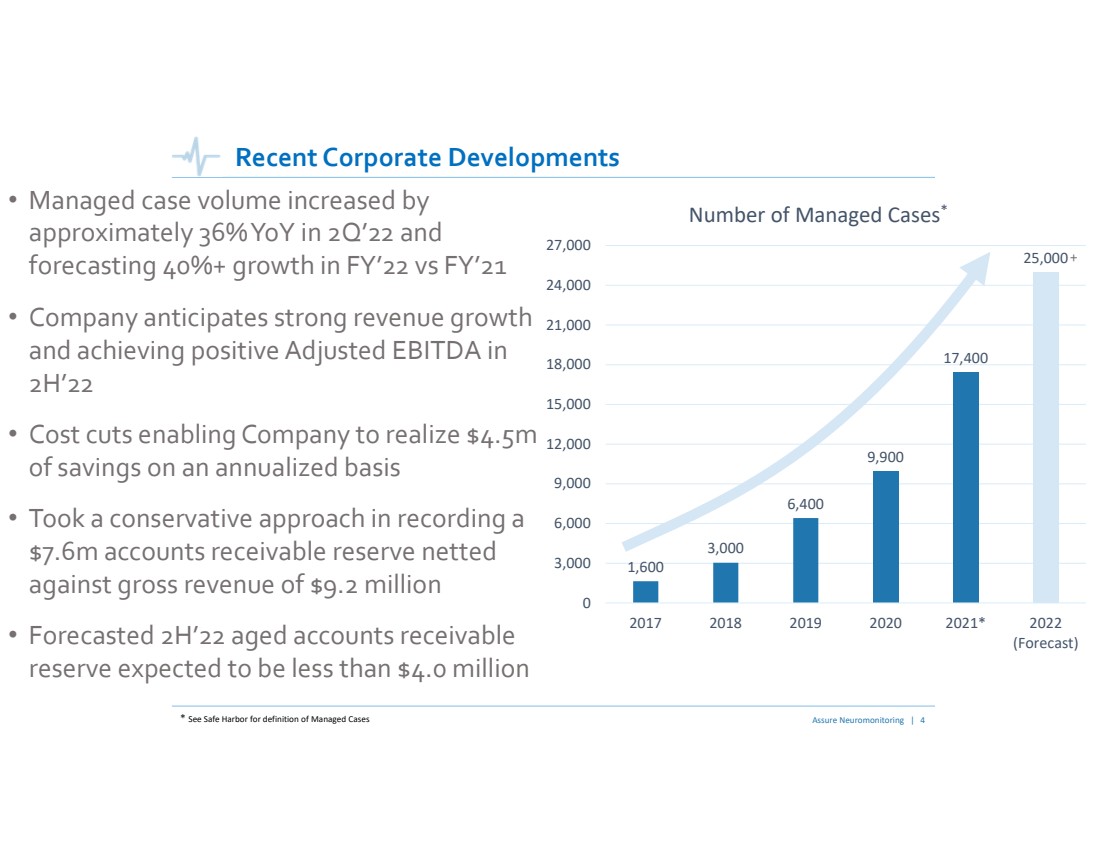

| Assure Neuromonitoring | 4 Recent Corporate Developments•Managed case volume increased by approximately 36% YoY in 2Q’22 and forecasting 40%+ growth in FY’22 vs FY’21 •Company anticipates strong revenue growth and achieving positive Adjusted EBITDA in 2H’22•Cost cuts enabling Company to realize $4.5m of savings on an annualized basis•Took a conservative approach in recording a $7.6m accounts receivable reserve netted against gross revenue of $9.2 million•Forecasted 2H’22 aged accounts receivable reserve expected to be less than $4.0 million 1,6003,0006,4009,90017,40025,00003,000 6,0009,00012,000 15,000 18,000 21,000 24,000 27,00020172018201920202021*2022(Forecast)Number of Managed Cases* +* See Safe Harbor for definition of Managed Cases |

| Assure Neuromonitoring | 5 Revenue Cycle Management Update•Reserved accounts receivable in 2Q’22 was the result of an accounting charge made against aged receivables; not an accrual adjustment based on collections•In the go‐forward, risk from aged receivables has been significantly reduced given the acceleration of collection velocity•Assure has recalibrated its resources to more effectively collect aged receivables and anticipates ultimately recovering a share of receivables reserved in 1H’22; This will result in net new revenue and margin from the collection of these aged receivables |

| Assure Neuromonitoring | 6 Streamlining Operations to Drive Cash Flow and Profitability•Cost reductions enabling the Company to realize $4.5m of savings on an annualized basis•These measures included trimming the workforce, salary reductions for the management team, withdrawing from certain low performing markets and reducing operating expenses•Assure added more resources to revenue cycle management and expects to accelerate payments and collect higher reimbursements•The Company is prioritizing growth resources in markets with substantial existing operational density, servicing facility‐wide outsourcing agreements and entering new markets with strong profitability profiles Assure remains on track to meet its guidance of performing 25,000+ managed cases in full-year 2022 |

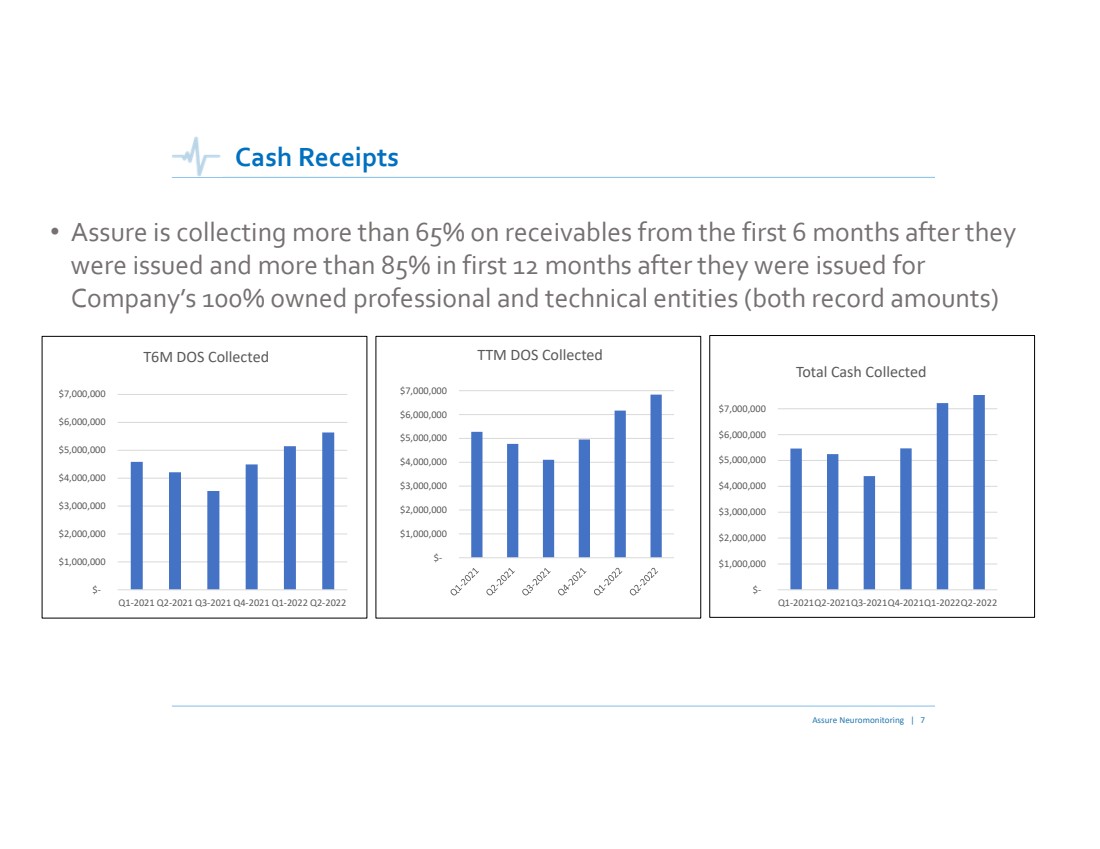

| Assure Neuromonitoring | 7 Cash Receipts•Assure is collecting more than 65% on receivables from the first 6 months after they were issued and more than 85% in first 12 months after they were issued for Company’s 100% owned professional and technical entities (both record amounts) $‐ $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000Q1‐2021Q2‐2021Q3‐2021Q4‐2021Q1‐2022Q2‐2022T6M DOS Collected $‐ $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 TTM DOS Collected $‐ $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000Q1‐2021Q2‐2021Q3‐2021Q4‐2021Q1‐2022Q2‐2022Total Cash Collected |

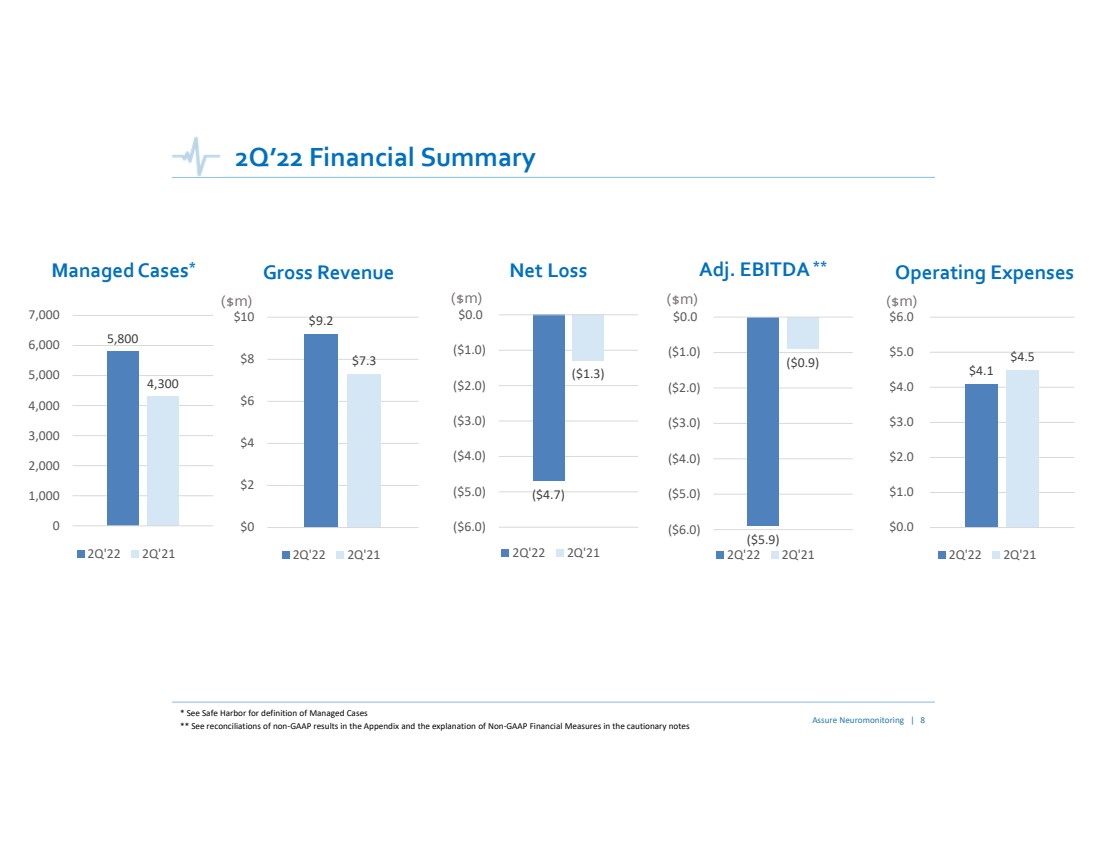

| 2Q’22 Financial Summary 5,8004,30001,000 2,000 3,000 4,000 5,000 6,000 7,000 2Q'22 2Q'21Managed Cases* $9.2$7.3$0$2$4$6$8$10 2Q'22 2Q'21GrossRevenue ($5.9)($0.9)($6.0)($5.0)($4.0) ($3.0)($2.0)($1.0)$0.0 2Q'22 2Q'21Adj. EBITDA**($m)($m)** See reconciliations of non‐GAAP results in the Appendix and the explanation of Non‐GAAP Financial Measures in the cautionary notes* See Safe Harbor for definition of Managed Cases $4.1$4.5$0.0$1.0 $2.0$3.0$4.0 $5.0 $6.0 2Q'22 2Q'21Operating Expenses($m) ($4.7)($1.3)($6.0)($5.0) ($4.0)($3.0)($2.0) ($1.0)$0.0 2Q'22 2Q'21Net Loss($m)Assure Neuromonitoring | 8 |

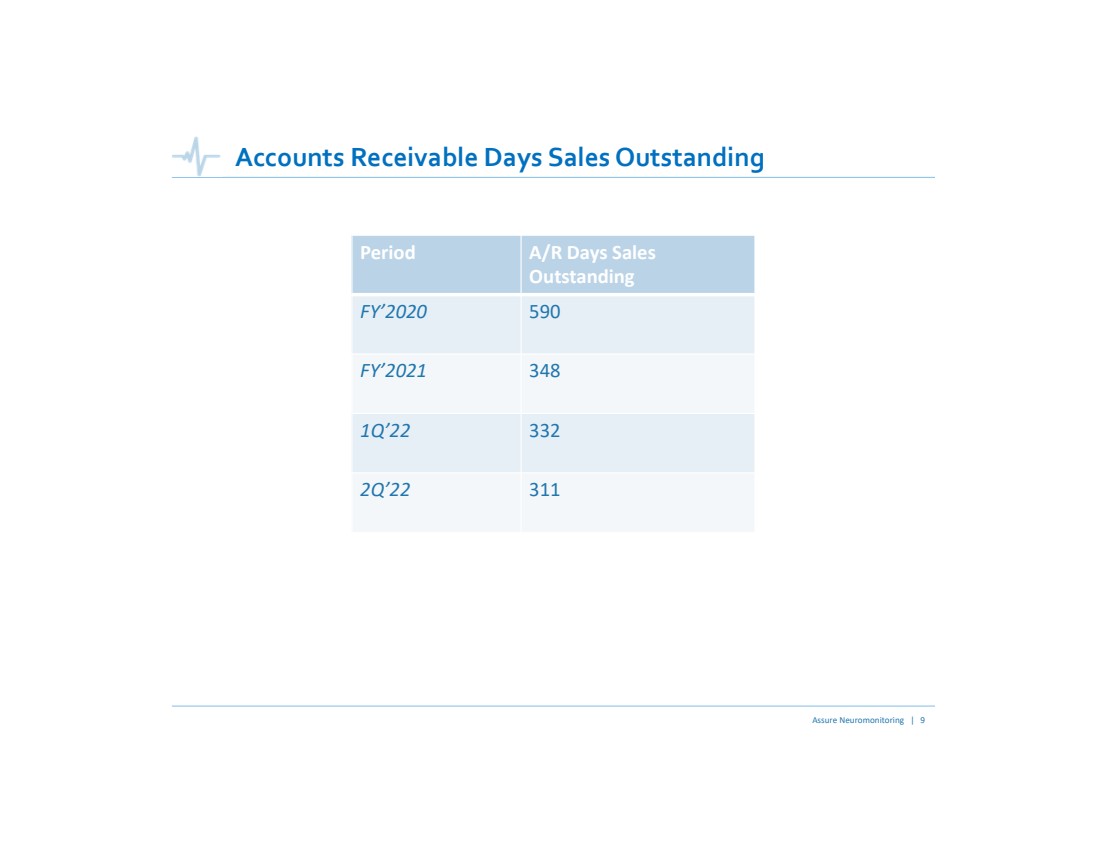

| Assure Neuromonitoring | 9 Accounts Receivable Days Sales Outstanding PeriodA/R Days Sales OutstandingFY’2020590FY’20213481Q’223322Q’22311 |

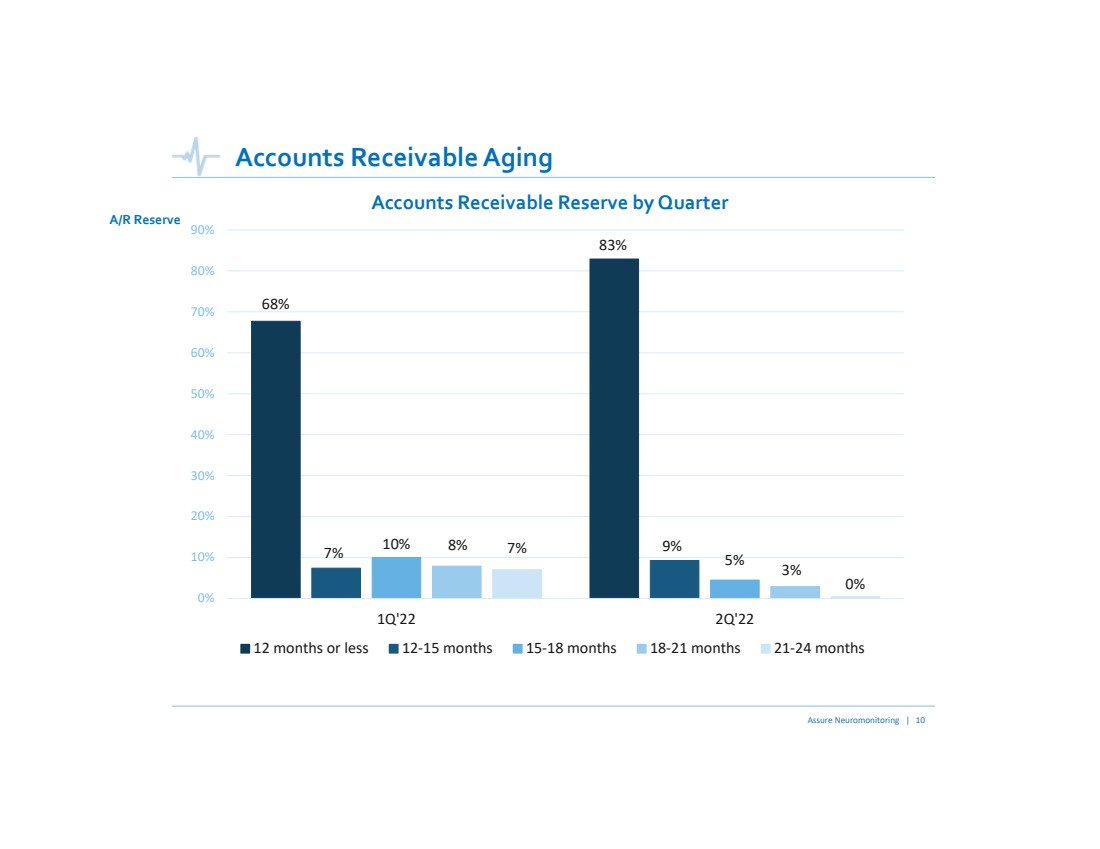

| Assure Neuromonitoring | 10 Accounts Receivable Aging 68%83%7%9%10%5%8%3%7%0%0%10% 20% 30% 40%50%60% 70% 80% 90%1Q'222Q'22Accounts Receivable Reserve by Quarter 12 months or less 12‐15 months 15‐18 months 18‐21 months 21‐24 monthsA/R Reserve |

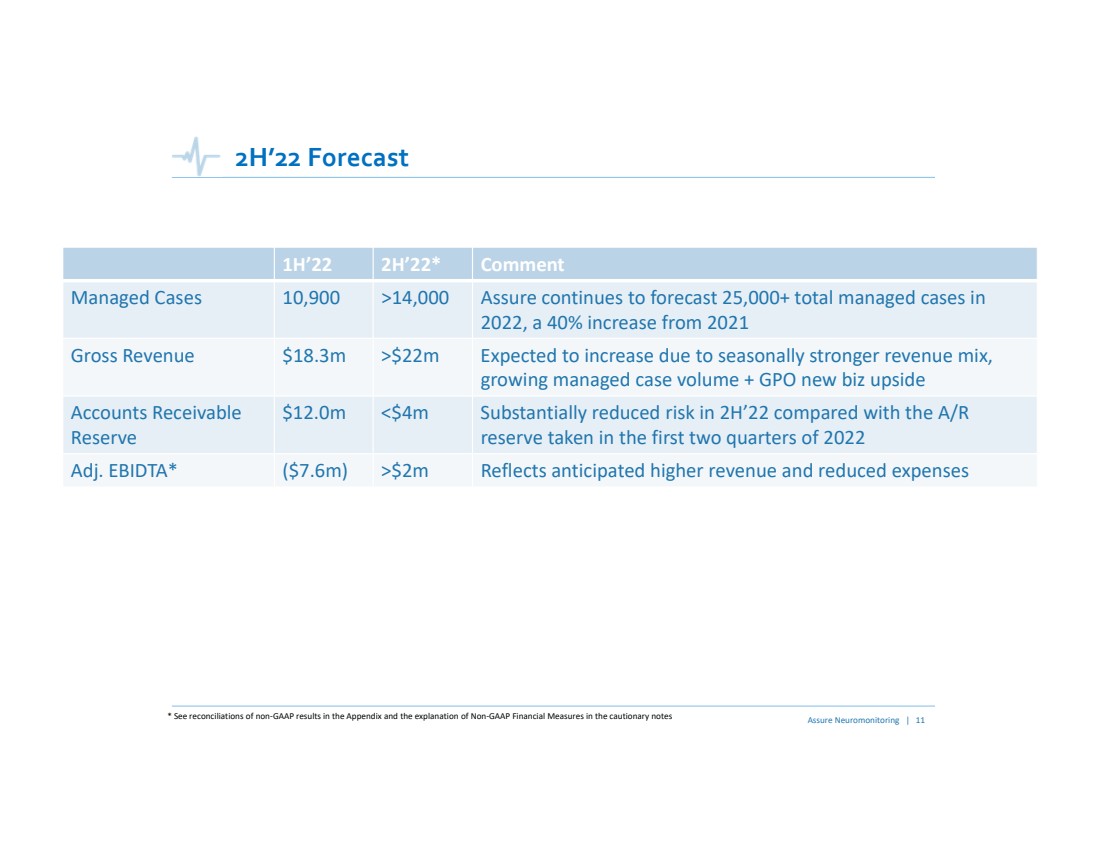

| 2H’22 Forecast 1H’222H’22*CommentManaged Cases10,900>14,000Assure continues to forecast 25,000+ total managed cases in 2022, a 40% increase from 2021Gross Revenue$18.3m>$22mExpected to increase due to seasonally stronger revenue mix, growing managed case volume + GPO new biz upsideAccounts Receivable Reserve$12.0m<$4mSubstantially reduced risk in 2H’22 compared with the A/R reserve taken in the first two quarters of 2022Adj. EBIDTA*($7.6m)>$2mReflects anticipated higher revenue and reduced expenses* See reconciliations of non‐GAAP results in the Appendix and the explanation of Non‐GAAP Financial Measures in the cautionary notesAssure Neuromonitoring | 11 |

| Q&AAssure Holdings7887 E. Belleview Ave., Suite 500, Englewood, CO(720) 617‐2526www.assureneuromonitoring.com Company ContactJohn FarlingerExecutive Chairman and CEOJohn.Farlinger@assureiom.com Investor RelationsScott KozakDirector, Investor and Media RelationsScott.Kozak@assureiom.com Assure Neuromonitoring | 12 |

| 2Q’22 Earnings Call ‐AppendixAugust 15, 2022 NASDAQ: IONM |

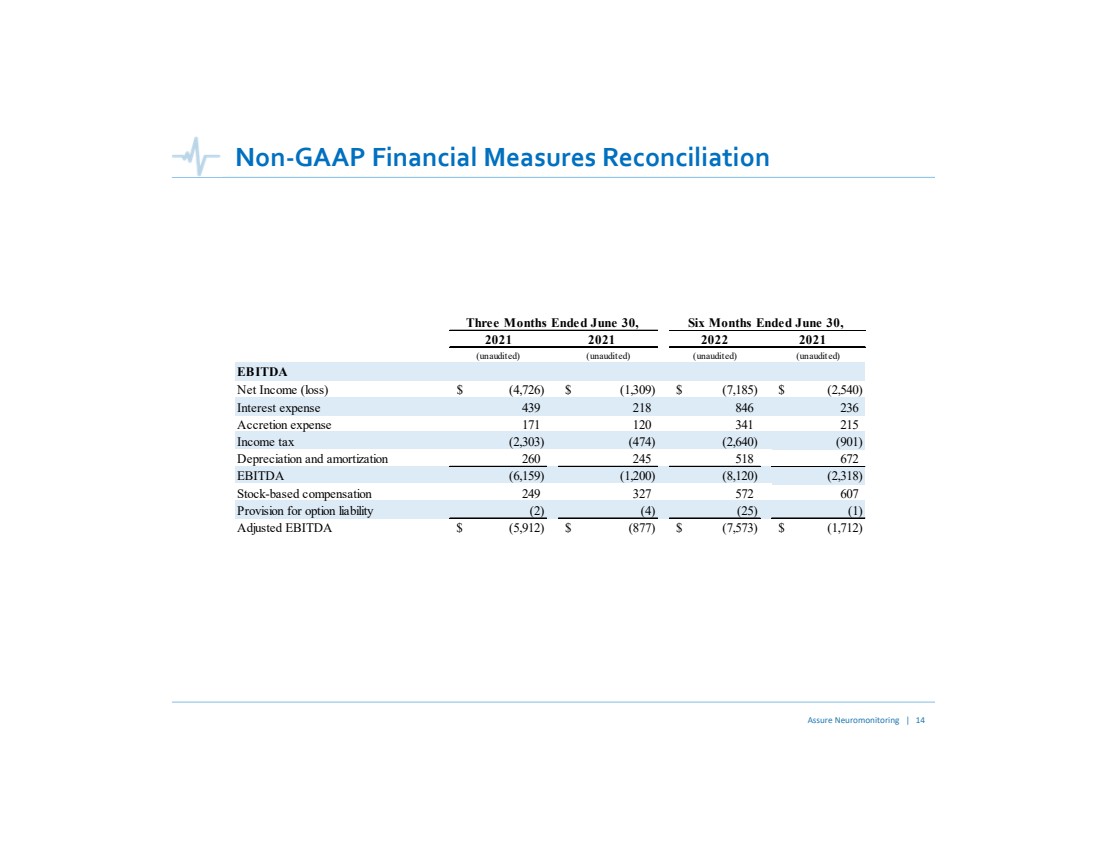

| Non‐GAAP Financial Measures Reconciliation Assure Neuromonitoring | 14 20212022(unaudited)(unaudited)(unaudited)(unaudited)EBITDA Net Income (loss)(4,726)$ (1,309)$ (7,185)$ (2,540)$ Interest expense439 218 846 236 Accretion expense 171 120 341 215 Income tax (2,303) (474) (2,640) (901) Depreciation and amortization 260 245 518 672 EBITDA (6,159) (1,200) (8,120) (2,318) Stock-based compensation249 327 572 607 Provision for option liability (2) (4) (25) (1) Adjusted EBITDA (5,912)$ (877)$ (7,573)$ (1,712)$ 20212021Three Months Ended June 30, Six Months Ended June 30, |