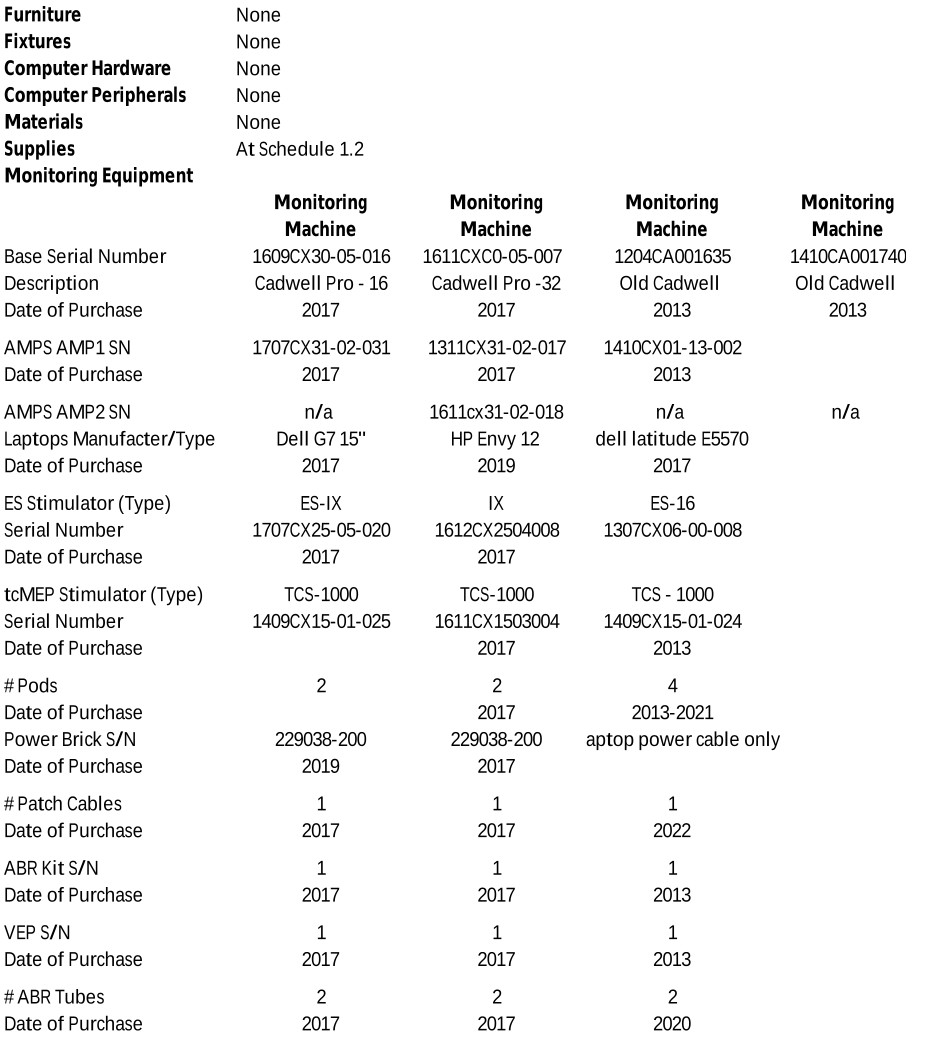

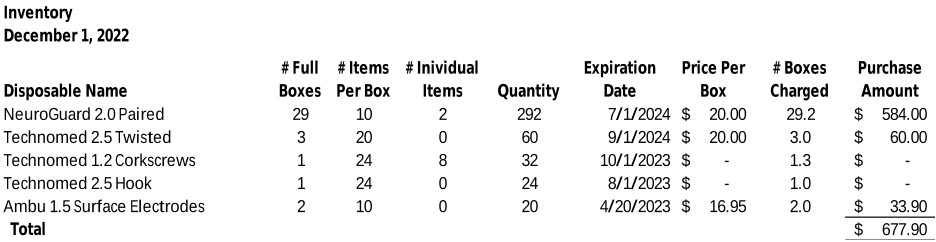

SCHEDULE 1.1

Tangible Personal Property

Repairs

AMP 1410CX01-13-0002 requires repairs, which Sellers estimate will cost approximately $1,500.

Exhibit 10.1

Assure Holdings Corp., a Delaware corporation (“Purchaser”), and each of NervePro LLC, a Colorado limited liability company (“NervePro”), Neuroprotect Neuromonitoring, LLC, a Colorado limited liability company (“Neuroprotect”), Neurotech Neuromonitoring, LLC, a Colorado limited liability company (“Neurotech”), and Nervefocus, LLC, a Colorado limited liability company (“Nervefocus,” and together with NervePro, Neuroprotect, and Neurotech, the “Sellers,” and each, a “Seller”) have entered into this Asset Purchase Agreement (this “Agreement”), dated December 30, 2022 (the “Effective Date”).

RECITALS

A.Sellers are engaged in owning and operating businesses that provide intraoperative neuromonitoring and related services (the “Business”).

B.Sellers desire to sell the Assets, as defined below, to Purchaser, and Purchaser desires to purchase the Assets, pursuant to the terms set forth below.

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants, promises, agreements, representations, warranties, and conditions contained herein, the parties agree as follows:

On the terms and subject to the conditions set forth in this Agreement, each Seller hereby sells, assigns, transfers, and delivers to Purchaser, and Purchaser hereby purchases, accepts, and acquires from each Seller, all of the right, title, and interest of such Seller in and to those assets that are used or held for use in the Business, free and clear of any and all liens, security interests, leases, or other encumbrances of whatever nature (the assets being transferred pursuant to this Agreement are collectively referred to herein as the “Assets”), but excluding the Excluded Assets (as defined in Section 1.15). The Assets include, without limitation, the following:

2

Subject to the adjustments described below, the purchase price to be paid by Purchaser to Sellers for the Assets shall be payable as follows:

3

4

5

6

7

8

9

10

11

THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES OF AMERICA. THE SECURITIES MAY NOT BE TRANSFERRED EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH ACT AND APPLICABLE STATE SECURITIES LAWS OR PURSUANT TO AN APPLICABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF SUCH ACT AND SUCH LAWS.

12

13

14

15

(c)The Assumed Liabilities.

16

Purchaser does not assume any Liabilities of Sellers with respect to any current or past employees of Sellers, any of Sellers’ employee benefits or benefit plans, any accrued vacation of Sellers’ employees, or any other employment related Liability of Sellers whatsoever. At the Closing, Sellers shall terminate all of its employees. Purchaser retains the right to decide, in its discretion, whether to employ or retain any employees of Sellers. Purchaser and Sellers agree that this Article IX is for the sole benefit of Purchaser, and that nothing in this Agreement creates a third-party beneficiary or other right (a) in any other person, including, without limitation, any employees of Sellers, or (b) to continued employment with Purchaser or any of its affiliates.

Sellers agree to (and to cause their respective employees, contractors, representatives, agents, and affiliates to) treat confidentially and not to disclose to any person or entity (other than an affiliate, employee, contractor, representative, or agent of such party who needs to know such information for the purpose of pursuing and consummating the transaction contemplated hereby) Confidential Information, and to not use Confidential Information in any manner or for any other purpose. Notwithstanding anything to the contrary in this Article X, if Sellers are requested or required to disclose Confidential Information, Sellers will promptly notify Purchaser and will afford Purchaser the opportunity to obtain a protective order or other appropriate remedy to maintain the confidentiality of the Confidential Information. If a protective order or other remedy is not available, Sellers will furnish only the portion of Confidential Information that Purchaser is advised in writing by its counsel that it is legally required to furnish and will use reasonable efforts to obtain, prior to disclosure, assurances that confidential treatment will be given thereto. “Confidential Information” means any information of the Business that is or reasonably ought to be considered confidential or proprietary, including information relating to processes, services, customer and supplier lists, pricing and marketing plans, policies and strategies, details of customer, supplier, and consultant contracts, operations methods, techniques, business plans, trade secrets, proprietary information, and all other intellectual property of, or related to, the Business

17

or Purchaser). This Article X shall survive the Closing and shall survive any termination of this Agreement.

18

19

[Signature Page(s) to Follow]

20

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Effective Date, notwithstanding the actual date of execution.

SELLERS: NervePro LLC By: Paul Elliott, Authorized Person Address: PO Box 150295, Lakewood, CO 80215 Email: pelliott@cbsi.md Neuroprotect Neuromonitoring, LLC By: Paul Elliott, Authorized Person Address: 3501 S Clarkson Street, Englewood, CO 80113 Email: pelliott@cbsi.md Neurotech Neuromonitoring, LLC By: Paul Elliott, Authorized Person Address: 3501 S Clarkson Street, Englewood, CO 80113 Email: pelliott@cbsi.md Nervefocus, LLC By: Paul Elliott, Authorized Person Address: PO Box 150295, Lakewood, CO 80215 Email: pelliott@cbsi.md | |

[Signature Page to Asset Purchase Agreement]

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Effective Date, notwithstanding the actual date of execution.

PURCHASER

ASSURE HOLDINGS CORP.

By:

Name:

Title: Authorized Signer

Address:

Email:

[Signature Page to Asset Purchase Agreement]

SCHEDULE 1.1

Tangible Personal Property

Repairs

AMP 1410CX01-13-0002 requires repairs, which Sellers estimate will cost approximately $1,500.

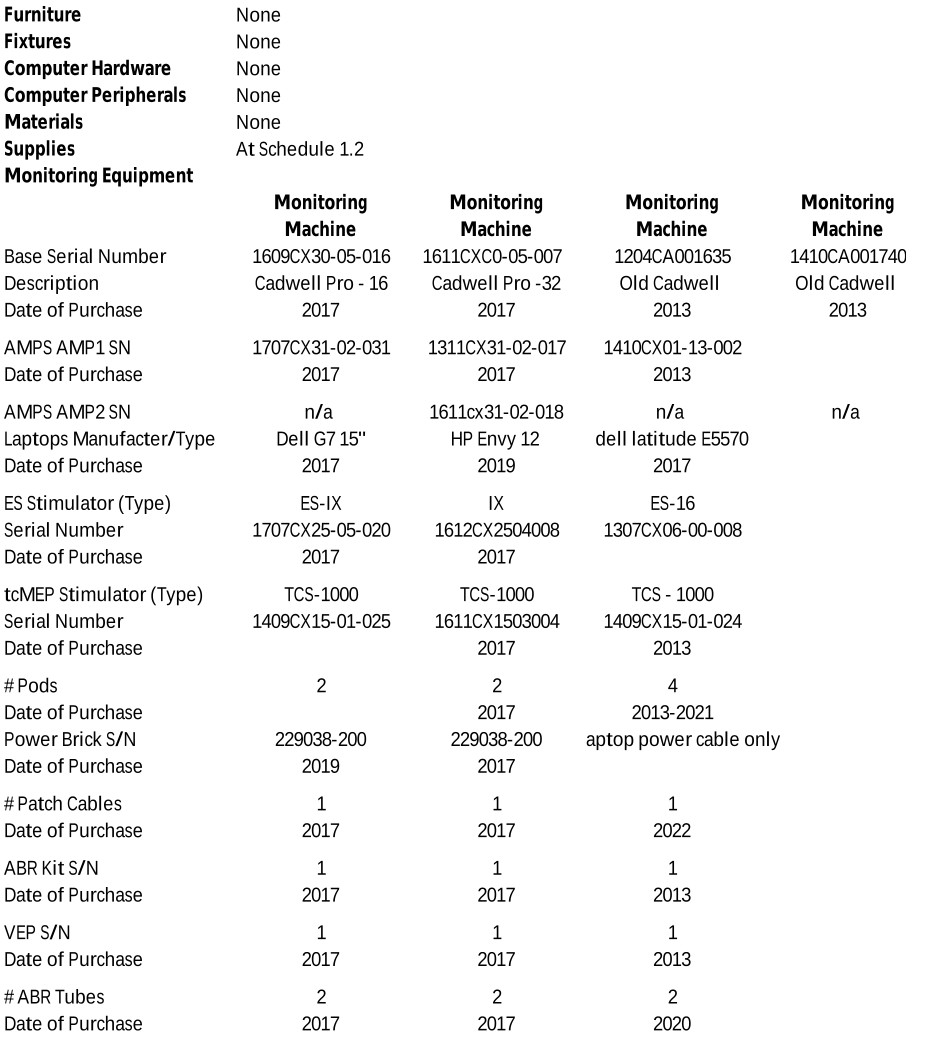

SCHEDULE 1.2

Inventory

[Signature Page to Asset Purchase Agreement]

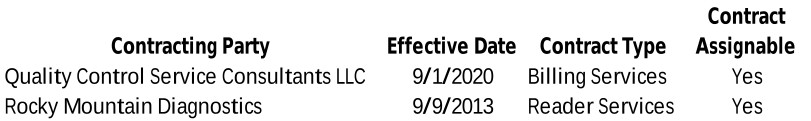

SCHEDULE 1.5

Contracts

[Signature Page to Asset Purchase Agreement]

SCHEDULE 1.6

Licenses

None

[Signature Page to Asset Purchase Agreement]

SCHEDULE 1.15

Excluded Assets

None

[Signature Page to Asset Purchase Agreement]

SCHEDULE 1.15(g)

Certain Excluded Assets

None

[Signature Page to Asset Purchase Agreement]

SCHEDULE 5.1(k)

Financial Statements

See attached

[Signature Page to Asset Purchase Agreement]

SCHEDULE 5.1(t)

Customers

None.

[Signature Page to Asset Purchase Agreement]